Standard refund - eligibility, documentation, deadlines - French equities (securities held in CBF)

Who can apply for a standard refund?

A standard refund of withholding tax on dividends from French equities is available to eligible beneficial owners if relief at source has not been obtained, as follows:

| Eligible beneficial owners | Effective rate of tax after refunda | Tax refund available |

Residents of Double Taxation Treaty (DTT) countries | Tax treaty rate or 25%, whichever is lower | 25% minus the tax treaty rateb |

Foreign individuals | 12.8% or tax treaty rate whichever is lower | 25% minus 12.8% or tax treaty rate |

Foreign CIVs | 0% or 15% when dividend of SIIC or SPICAV | 25% or 10% |

| EU Parent Companiesc | Tax treaty rate or 25% whichever is lower | Minus 25% or the tax treaty rateb |

Particular foreign entities | Tax treaty rate or 25%, whichever is lower | 25% minus the tax treaty rateb |

a. 30% until 31 December 2019, 28% until 31 December 2020 and 26.5% until 31 December 2021.

b. Expressed as a percentage of the gross dividend amount.

c. Amount of relief will be 0% if the DTT rate exceeds 25% (30% until 31 December 2019, 28% until 31 December 2020 and 26.5% until 31 December 2021).

d. Only if requesting the benefit of the DTT.

Documentation requirements

Reclaim based on DTT rates

Documentation requirements are the same for all types of eligible beneficial owners claiming the DTT rates, as follows:

- Form 5000 Certificate of Residence;

- Form 5001 Calculation and Repayment of Withholding Tax on Dividends (must be printed on both sides, but only the details of the second page must be completed);

- Power of Attorney, if applicable;

- Letter of Request to LuxCSD for Reclaim of French Withholding Tax (V2).

plus, if the beneficial owner is not a newly created investment scheme (other than foreign CIVs):

- A Form 5000 Attestation of Percentage (which, if the accounting period does not cover all the payments for which the refund is requested, must indicate the follow-up accounting period), signed by the beneficial owner, not by the fund’s local tax authorities;

or, if the beneficial owner is a newly created investment scheme (other than foreign CIVs):

- A first Form 5000 Attestation of Percentage with the first accounting period, with "Newly created fund" mentioned in Box II, signed by the beneficial owner, not by the fund’s local tax authorities; and

- A Letter (self declaration) stating the date of establishment of the newly created fund, duly completed and signed by the fund; and

- If the accounting period does not cover all the payments for which the refund is requested, a Form 5000 Attestation of Percentage indicating the follow-up accounting period, signed by the beneficial owner, not by the fund’s local tax authorities

Note: Forms 5000 and 5001 are available on the website of the French Tax Authorities.

Additional special documentation is required for various types of mutual funds, pension funds and particular foreign entities.

Form descriptions are presented according to the procedures available for relief and/or reclaim of withholding tax on income from French equities.

As a general rule, for beneficial owners for whom there is no provision in the Double Taxation Treaty (DTT) between their country of residence and France, an additional tax attestation is required to confirm that the beneficial owner is subject to tax.

The respective attestation, the intention of which is to prove that the beneficial owner fulfils the residency conditions stated within the DTT, must be provided in addition to the standard documentation required for DTT residents.

Note: This information is included to assist customers and should not be considered to be exhaustive.

Attestations are required in the case of the following institutions, as indicated:

EU Parent Companies

EU Parent Companies can benefit from a standard refund of withholding tax from French equities only if they reclaim the DTT rates. A full refund based on provisions of the article 119 ter of the CGI (Code Général des Impôts) is not applicable.

In order to obtain the refund, the EU Parent Companies must complete both pages of form 5001. Page 1 must be dated, signed and stamped by the beneficial owner or its legal representative.

Canadian Mutual Funds

The French Tax Authorities, in their Statement of Practice (14 B-1-06), provided guidance on the eligibility of Canadian Mutual Funds for tax treatment under the DTT between Canada and France.

Eligible funds include:

- Mutual Fund Corporations (sociétés de placement à capital variable);

- Mutual Fund Trusts (fiducies de fonds communs de placement);

- Pooled Fund Trusts (fiducies de fonds mis en commun);

- Unit Trusts (fiducies d'investissement à participation unitaire).

Tax reductions and tax exemptions are applicable as follows:

- Only to the portion of French-sourced income that is not subject to tax in Canada and is redistributed by the mutual fund to its effective beneficial owners; and

- Only when the percentage of distribution rights held by Canadian residents meets the ownership threshold.

The standard refund procedure is applicable. Customers are required to send, in addition to the documentation required for DTT residents, an original Form 5002 (a Form 5000 is not required) for interest payments, together with the following original documents per payment:

- For Mutual Fund Corporations: the specific Attestation for Canadian Mutual Fund Corporations;

- For Mutual Fund Trusts, Pooled Fund Trusts and Unit Trusts: the Attestation for Canadian Mutual Funds.

Note: The attestation must be dated prior to the year of the respective income payment for which the reclaim is made.

Canadian Pension Funds

The French Tax Authorities, in their Statement of Practice (14 B-1-05), provided guidance on the eligibility of Canadian Pension Funds for tax treatment under the DTT between Canada and France.

Eligible funds include:

- Registered Pension Plan (RPP) (Régime de Pension Agrée (RPA));

- Registered Retirement Income Fund (RRIF) (Fonds Enregistrés de Revenus de Retraite (FERR));

- Registered Savings Plan (RSP) (Régime Enregistré d'Epargne Retraite (REER)).

The standard refund procedure is applicable. Customers are required to send, in addition to the documentation required for DTT residents, an original Form 5002 (a Form 5000 is not needed) for interest payments, together with the specific Attestation for Canadian Pension Funds in English or French. Original documents are required per payment.

Note: The attestation must be dated prior to the year of the income payment(s) for which the reclaim is made.

Spanish Pension Funds

Spanish Pension Funds do not fall under the categories defined in Article 4 of the tax treaty signed on 10 October 1995 between Spain and France and, as a consequence, the Non-Residents Tax Office requires additional supporting documentation as proof that they are subject to tax in Spain.

A Spanish pension fund can enjoy tax treaty benefits provided that it meets the following eligibility criteria:

- The fund is considered as resident in Spain under the DTT between Spain and France; and

- The fund is subject to tax in Spain; and

- The fund is effectively paying tax in Spain on its local and French-sourced income.

The standard refund procedure is applicable. Customers are required to send, in addition to the documentation required for DTT residents, an original Tax Attestation issued by the Spanish Tax Authorities in both Spanish and French (there is no official template) and certifying that the beneficial owner is liable (without exemption) to taxation at the normal rate on its income (including French-sourced income).

Note: The attestation must be dated prior to the year of the income payment(s) for which the reclaim is made.

Irish Mutual Funds, South African Pension Funds and UK charities

There is no specific provision for these entities under the applicable tax treaty and so the Non-Residents Tax Office requires additional supporting documentation as proof that they are subject to tax in their country of residence.

Obtaining relief from withholding tax

The standard refund procedure is applicable. Customers are required to send, in addition to the documentation required from DTT residents, an original Tax Attestation issued by the local tax authorities in both French and English and certifying that the beneficial owner is liable (without exemption) to taxation at the normal rate on its income (including French-sourced income).

Note: The attestation must be dated before the year of the income payment(s) for which the reclaim is made.

GBRs

In order to apply for the refund of the withholding tax applied on French-sourced dividend income, each partner of the GBR should provide, by the deadlines prescribed by LuxCSD, the following documentation:

- Form 5000 Certificate of Residence, per partner;

- Form 5001 Calculation and Repayment of Withholding Tax on Dividends (must be printed on both sides, but only the details of the second page must be completed);

- The GBR Attestation;

- Letter of Request to LuxCSD for Reclaim of French Withholding Tax (V2);

- A cover letter, including the names of all the partners applying for the standard refund and certifying that these names are part of the relevant GBR;

All the documentation mentioned above must be sent together with a cover letter mentioning the relevant GBR.

UCITSs (other than eligible foreign CIV), pension funds, charities, foundations/associations, trusts, partnerships etc.

In order to apply for the refund of the withholding tax applied on French-sourced dividend income, the relevant beneficial owner should provide, by the deadlines prescribed by LuxCSD, the following documentation:

- Form 5000 Certificate of Residence;

- Form 5000 attestation of funds (for investment schemes only);

- Form 5001 Calculation and Repayment of Withholding Tax on Dividends (must be printed on both sides, but only the details of the second page must be completed);

- A tax attestation, in the original, with the first standard reclaim of that fiscal year, a copy of said attestation thereafter accepted for all future reclaims during the same fiscal year;

- Letter of Request to LuxCSD for Reclaim of French Withholding Tax (V2).

U.S. residents

For the standard refund procedure, the following documentation is required for U.S. residents:

- A certificate of residence (see below);

- Form 5001 (must be printed on both sides, but only the details of the second page must be completed);

- Power of Attorney (if applicable);

- Letter of Request to LuxCSD for Reclaim of French Withholding Tax (V2).

The certificate of residence should be provided, depending on the status of the beneficial owner, as follows:

U.S. pension funds, nonprofit organisations and U.S. RICs, REITs and REMICs:

- An IRS Form 6166 is mandatory and must confirm the legal status and the Internal Revenue Code section to which it refers, as follows:

- U.S. Pension funds: Status 401 (a), 401 (b), 403 (b) or 457;

- U.S. Not For Profit Organisations: Status 501 (c) 3;

- U.S. RICs, REITs, REMICS: the legal status of the final beneficiary and its tax ID in the U.S.A., if there is one.

- Form 5000 non-certified.

Other U.S. resident entities:

A certificate of residence is mandatory, but the certification can be either of the following:

- A 6166 certificate duly completed and certified by the IRS; and

- Form 5000 non-certified; or

- Form 5000 duly completed and certified by the U.S. intermediary in Box VI; or

- Form 5000 duly completed and certified by the IRS in Box IV.

The IRS Form 6166 must be provided, in the original, with the first reclaim application of that fiscal year, a copy thereafter being accepted for all future reclaims during this fiscal year.

The Form 5000 must be provided, in the original, per reclaim application.

The required documentation must be provided by the deadlines prescribed by LuxCSD.

Note: The fiscal year indicated on the 6166 certificate determines the validity; if not mentioned on the 6166 document, the certification date will be taken into consideration.

Reclaims based on domestic law rates

Foreign individuals

A standard refund of withholding tax on dividends from French equities is available to eligible foreign individuals if neither relief at source nor quick refund has been obtained, as follows. In rare cases, foreign individuals may obtain a DTT rate lower than the 12.8% domestic rate. The reclaim procedure is the same in both cases.

Documentation requirements

In order to obtain a standard refund of withholding tax, eligible foreign individuals must provide LuxCSD with the following documentation within the prescribed deadline:

- Form 5000 Certificate of Residence or a separate Certificate of Residence issued by the foreign individual tax authorities;

- Form 5001 Calculation and Repayment of Withholding Tax on Dividends (must be printed on both sides, but only the details of the second page must be completed);

- Power of Attorney, if applicable;

- Letter of Request to LuxCSD for Reclaim of French Withholding Tax (V2).

Foreign CIVs

A standard refund of withholding tax on dividends from French equities is available to eligible foreign CIVs if relief at source nor quick refund has been obtained, as follows:

Documentation requirements

In order to obtain a standard refund of withholding tax, eligible foreign CIVs must provide LuxCSD with the following documentation within the prescribed deadline:

- A Letter of Request to LuxCSD for Reclaim of French Withholding Tax (V2);

- An attestation of comparability of the foreign CIV with a French CIV

- that can be a UCIT attestation delivered by the competent local authorities or a copy of the prospectus;

- or

- A completed RPPM form (one form per fund or sub-fund).

- that can be a UCIT attestation delivered by the competent local authorities or a copy of the prospectus;

- A power of attorney, if RPPM not signed by the beneficial owner;

- A form 5001 Calculation and Repayment of Withholding Tax on Dividends (must be printed on both sides, but only the details of the second page must be completed).

- Copy of prospectus or other evidencing documentation, only upon request of the French tax authorities.

Non-EU CIVs cannot obtain a standard refund through LuxCSD. A contentious reclaim must be filed directly with the FTA at the following address:

Direction des Impôts des Non-Résidents (DINR)

Pôle RCM

10, rue du Centre

TSA 30012

93465 NOISY-LE-GRAND

France

The contentious reclaim file must include:

- The new RPPM BOI-FORM-000089; and

- All the supporting documentation as required by the FTA.

A positive decision of the FTA allows the non-EU CIV to obtain a relief at source on the dividend payments paid between the date the FTA decision has been issued and 31 December of the second year following that decision.

Important note: LuxCSD does not assist in that contentious reclaim process. Customers should seek the advice of their own tax advisors.

Statutory deadline for reclaiming withholding tax

For customers claiming domestic law rates

The statutory deadline for reclaiming withholding tax is two years after the end of the calendar year in which the dividend payment is made.

For customers claiming DTT rates

Unless otherwise stipulated in the tax treaty, the statutory deadline for reclaiming withholding tax is two years after the end of the calendar year in which the dividend payment is made.

Exceptions to the above are reclaim applications for beneficial owners that are residents of the following countries where the statutory deadline is more than two years after the end of the calendar year in which the interest payment is made, as indicated:

Zimbabwe | Three (3) years after the income payment date; |

India | Three (3) years after the end of the calendar year in which the interest is paid; |

Netherlands | Three (3) years after the end of the calendar year in which the interest is paid; |

Germany | Four (4) years after the end of the calendar year in which the interest is paid. |

LuxCSD deadline for standard refund applications

The deadline by which LuxCSD must receive the documentation for an application is at the latest two months before the statutory deadline.

All reclaim applications received after this deadline will be processed by LuxCSD on a “best efforts” basis. However, in such cases, LuxCSD will apply an extra charge and accepts no responsibility for forms that have not reached the French Tax Authorities by the date considered to be the statute of limitations deadline.

Important note: for reclaims on dividends paid before 10 April 2018 please refer to the deadline under Market Taxation Guide – France (securities held in BNP Paribas Securities Services)

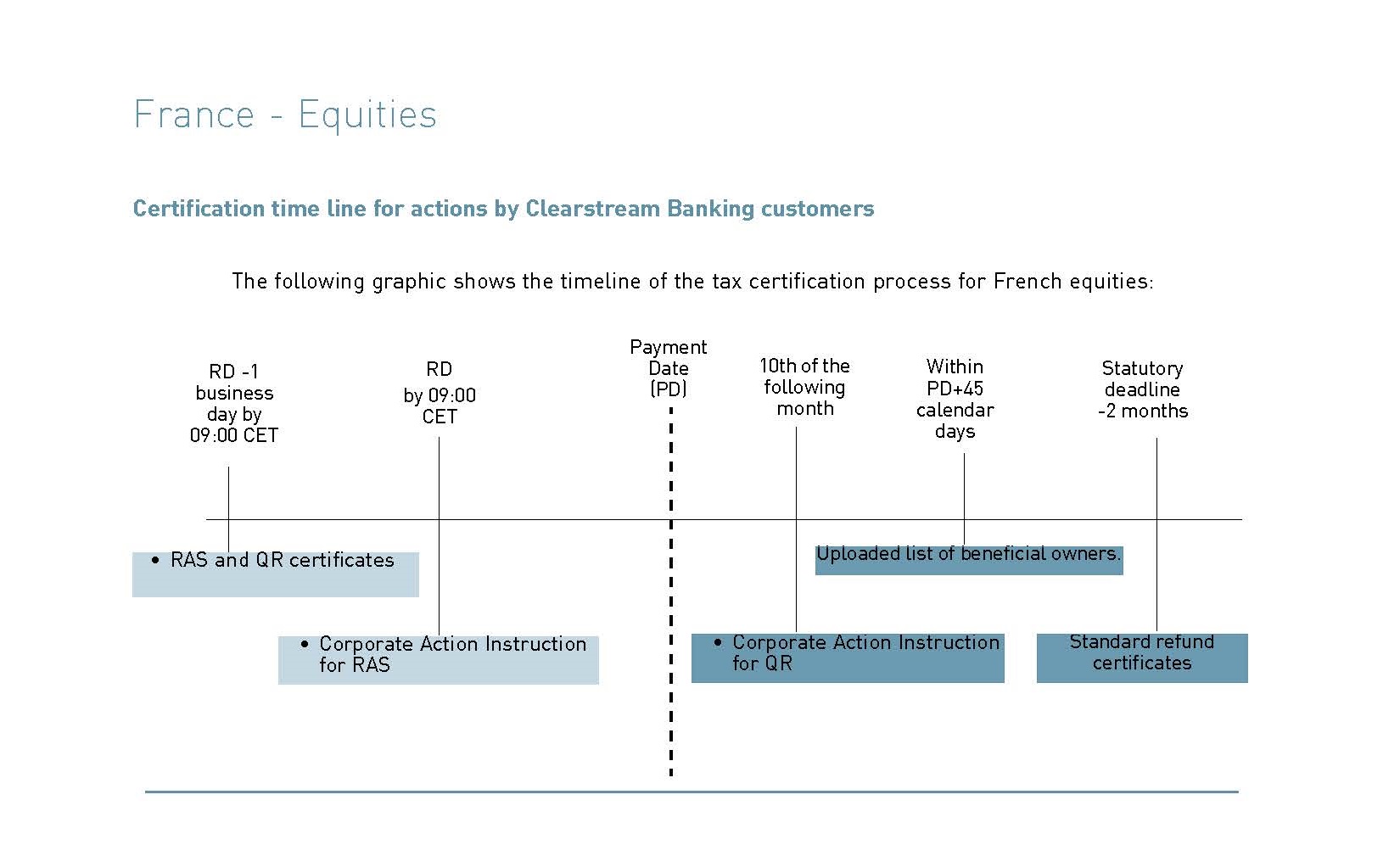

Certification timeline for actions by LuxCSD customers:

Click on the image to view the diagram showing the timeline for actions by LuxCSD customers.

When are refunds received?

The estimated time for receiving a refund is from six months to two years, depending on when the application is filed and the complexity of the information supplied in the reclaim form.

LuxCSD has collected information from sources considered reliable but does not guarantee the accuracy of the timings presented.

Notes on tax reclaim

Customers warrant the completeness and accuracy of the information they supply to LuxCSD.

It is the customer's responsibility to determine any entitlement to a refund of tax withheld, to complete the forms required correctly and to calculate the amount due. LuxCSD is under no obligation to carry out any investigation in respect of such information.

With respect to tax reclaims in general, customers are reminded that LuxCSD accepts no responsibility for their acceptance or non-acceptance by the tax authorities of the respective country.