Relief at source - eligibility, documentation, deadlines - French equities (securities held in CEU)

Who can obtain relief at source?

Relief at source from withholding tax on dividends from French equities is available through LuxCSD for beneficial owners as follows:

| Eligible beneficial owners | Rate applicable at source |

| Residents of Double Taxation Treaty (DTT) countriesa | Tax treaty rate |

Foreign individuals | 12.8% or tax treaty rate whichever is lower |

Foreign Collective Investment Vehicles (CIVs) | 0% or 15% when dividend of SIIC or SPICA V |

EU parent companies | 0% or tax treaty rate |

Not-for-profit organisations | 15% |

Foreign tax-exempt entities | 0% |

Particular foreign entities | Tax treaty rate |

French residents (direct clients) | 0% |

a. Simplified procedure is not available to the residents of Singapore.

Relief at source is available through various procedures for which the documentation requirements depend on the status and residency of the beneficial owner, as follows:

Note: In all cases, if the required documentation is not provided within the deadlines, the standard rate of 25% will be applicable by default.

For residents of Double Taxation Treaty (DTT) countries - the "simplified procedure"

On condition that the required certification, beneficial owner information and breakdowns are provided, this relief at source procedure allows for dividend payments to be made directly at a reduced tax rate to any non-resident beneficial owner that:

- Resides in a country that has signed a DTT with France that provides for a reduced withholding tax rate; and

- Meets the conditions laid down by the applicable DTT to obtain the benefit of the reduced withholding tax rate. Among these conditions, the distributed income paid by the company resident in France must be liable to income tax in the beneficial owner’s country of residence.

For foreign resident individuals - the "simplified procedure"

On condition that the required certification, beneficial owner information and breakdowns are provided, this relief at source procedure allows for dividend payments to be made directly at the standard tax rate of 12.8% to any non-resident beneficial owner that is an individual.

For foreign CIVs – the “simplified procedure”

On condition that the required certification, beneficial owner information and breakdowns are provided, this simplified procedure allows for dividend payments to be made directly at 100% (or 85% if a distribution by a SIIC or SPPICAV) to beneficial owners that are:

- UCITS IV: UCITS established in a European Union Member State and governed by Directive 2009/65/EC of 13 July 2009 (the “UCITS IV” directive);

- Certain alternative investment funds (AIFs) established in a European Union or European Economic Area Member State and governed by Directive 2011/61/EU of 8 June 2011 (the “AIFM” directive).

For foreign CIVs (non-EU) – O% or reduced rate for eligible CIV

On condition that a positive decision to a contentious reclaim from the Direction des impôts des non résidents (DINR) was obtained, non-EU CIVs can elect to a relief at source on distributions occurring between the date the FTA decision has been issued and 31 December of the second year following that decision.

For EU parent companies - through one of two procedures

- The Double Taxation Treaty (DTT) procedure according to the provisions stated in the relevant DTT between the country of residence of the parent company and France; or

- The European 0% procedure if the EU parent company and the French subsidiary company meet the conditions stated in the European Directive 90/435/EEC of 23 July 1990.

For not-for-profit organisations - 15% for eligible beneficial owners

Eligible foreign not-for-profit organisations must, before requesting that 15% withholding tax be applied, obtain a Non-Profit Organisations Certificate issued by the Direction des Impôts des Non-Résidents (DINR).

For foreign tax-exempt entities - 0% for eligible beneficial owners

Beneficial owners that are eligible exempt-entities under article 131 Sexies I or II may apply for tax exemption at source according to the French legislation.

For particular foreign entities - the “simplified procedure”

- For GBRs

On condition that the required certification, partner’s information and breakdowns are provided, this relief at source procedure allows for dividend payments to be made directly at the DTT rate to any GBR’s partner that meets the conditions to benefit from the DTT under the procedure applicable to foreign transparent partnerships (statement of practice 4 h-5-07 dated 29 March 2007). - For GmbH & Co. KG, KG, OHG

On condition that the required certification and specific attestations are provided, the relief at source procedure allows for dividend payments to be made directly at the DTT rate. - For UCITSs, pension funds, charities, foundations/associations, trusts, partnerships etc.

On condition that the required certification, beneficial owner information and breakdowns are provided, this relief at source procedure allows for dividend payments to be made directly at the DTT rate to any non-resident beneficial owner of one of the above entities that are effectively subject to tax in their country of residence. - For U.S. residents (including U.S. pension funds, non-profit organisations and RICs, REITs and REMICs)

On condition that the required certification, beneficial owner information and breakdowns are provided, this relief at source procedure allows for dividend payments to be made directly at the DTT rate to any non-resident beneficial owner of one of the above entities that meets the conditions laid down by the applicable DTT to obtain the benefit of the reduced withholding tax rate. Among these conditions, the distributed income paid by the company resident in France must be liable to income tax in the beneficial owner’s country of residence. - For French residents (direct clients) gross payment

On condition that the French resident is the direct client of LuxCSD and that the required documentation is provided, this procedure allows a gross dividend payment. It is the responsibility of the French resident to comply with all reporting and/or tax application obligations imposed by the French legislation.

Documentation requirements

There are different documentation requirements depending on the residence status and legal status of the beneficial owner, as follows:

Residents of Double Taxation Treaty (DTT) countries

- Form 5000 Certificate of Residence;

- One-Time Certificate for French securities;

- Corporate action instruction, if applicable;

- Per-payment Detailed List of Beneficial Owners, if applicable;

- Power of Attorney, when applicable;

plus, if the beneficial owner is not a newly created investment scheme (other than foreign CIVs):

- A Form 5000 Attestation of Percentage (which, if the accounting period does not cover all the payments for which the relief is requested, must indicate the follow-up accounting period), signed by the beneficial owner, not by the fund’s local tax authorities;

or, if the beneficial owner is a newly created investment scheme (other than foreign CIVs):

- A first Form 5000 Attestation of Percentage with the first accounting period, with "Newly created fund" mentioned in Box II, signed by the beneficial owner, not by the fund’s local tax authorities; and

- A Letter (self declaration) stating the date of establishment of the newly created fund, duly completed and signed by the fund; and

- If the accounting period does not cover all the payments for which the relief is requested, a Form 5000 Attestation of Percentage indicating the follow-up accounting period, signed by the beneficial owner, not by the fund’s local tax authorities.

Foreign individuals

- Form 5000 Certificate of Residence or a Certificate of residence issued by the tax authorities of the country of residence of the foreign individual;

- One-Time Certificate for French securities;

- Corporate action instruction, if applicable;

- Per-payment Detailed List of Beneficial Owners, if applicable;

- Power of Attorney, when applicable.

Foreign CIVs

- One-Time Certificate for French securities;

- RPPM (revenus et profits du patrimoine mobilier) form;

- Corporate Action Instruction,if applicable;

- Per-payment Detailed List of Beneficial Owners, if applicable;

- Power of Attorney, when applicable.

Foreign CIVs – Non-EU

- One-Time Certificate for French securities;

- RPPM (revenus et profits du patrimoine mobilier-Non-EU CIVs) form;

- Decision letter of the DINR;

- Corporate Action Instruction, if applicable;

- Per-payment Detailed List of Beneficial Owners, if applicable;

- Power of Attorney, when applicable.

EU parent companies

- Form 5000 - Certificate of Residence;

- Form 5001 - Calculation and repayment of withholding tax on dividends;

- Self-certification for qualified European Parent Companies;

- Corporate action instruction, if applicable;

- Power of Attorney, when applicable.

Not-for-profit organisations (except for U.S. residents - see below)

To qualify for relief as a not-for-profit organisation, a Not-for-Profit Organisations Certificate must be obtained by submitting the following documentation directly to the Direction des Impôts des Non-Résidents (DINR).

- Questionnaire;

- The founding documents of the beneficial owner’s organisation.

- A copy of the minutes of the General Assembly meetings and the budgets detailing the main revenue and expenditure items and, if the case arises, copies of the directors’ pay slips for the last three financial years.

- Other supporting documentation upon request (for example, proving the place of establishment of the organisation).

N.B.: Submission of the above-mentioned documents is only a precondition for obtaining the certificate. The DINR will decide whether or not to issue the certificate, based on their own review of the request. LuxCSD is not involved in this process.

When qualified, to obtain relief at source, the following documents must also be submitted to LuxCSD:

- Not-for-Profit Organisations Certificate;

- Corporate action instruction, if applicable.

Foreign exempt entities

- One-Time Certificate for French securities;

- One-Time Attestation Article 131 sexies

- Copy of the DLF Agreement letter (for 131 sexies II only)

- Corporate action instruction, if applicable;

- Power of Attorney, when applicable;

Particular foreign entities

For all of the below entities:

- One-Time Certificate for French securities;

GBRs

- Form 5000 Certificate of Residence for each partner, with the partner's personal profession (not the status of the GBR) in the “profession” field;

- An original GBR attestation, under the letterhead of the GBR, signed by the legal representative of the GBR, confirming the percentage of the rights of each associate in the GBR and the regime of tax transparency from which the GBR benefits in its country of residence and corresponding to the data from the last general assembly. The document is required on an annual basis, issued after the last general assembly and should be valid for less than one year at pay date;

- A cover letter with the names of all the partners applying for the simplified procedure and certifying that these names are part of the relevant GBR;

- Per-payment Corporate Action Instruction, if applicable;

- Per-payment Detailed List of Beneficial Owners, if applicable.

GmbH & Co. KG, KG, OHR companies:

- That have opted for the corporate tax:

- Form 5000 Certificate of Residence in the name and status of the company;

- An original attestation, confirming that the company has opted for the corporate tax;

- Per-payment Corporate Action Instruction, if applicable.

- That have opted for the income tax:

- Form 5000 Certificate of Residence in the name of each partner, with the partner's personal profession in the field “profession”. A Form 5000 with the status of the company will be considered as not valid;

- An original attestation, confirming that the company has opted for the income tax;

- Per-payment Corporate Action Instruction, if applicable.

UCITSs (other than eligible foreign CIVs), pension funds, charities, foundations/associations, trusts, partnerships etc.

- Form 5000 Certificate of Residence;

- Form 5000 Attestation of fund (for investment schemes only);

- Per-payment Corporate Action Instruction, if applicable;

- Per-payment Detailed List of Beneficial Owners, if applicable.

U.S. residents

A certificate of residence, provided according to the status of the beneficial owner, as follows:

U.S. pension funds, not-for-profit organisations and U.S. RICs, REITs and REMICs:

- An IRS Form 6166 (mandatory), confirming the legal status and the Internal Revenue Code section to which it refers, as follows:

- U.S. pension funds: Status 401 (a), 401 (b), 403 (b) or 457;

- U.S. Non-profit organisations: Status 501 (c) 3;

- U.S. RICs, REITs and REMICs: the legal status of the final beneficiary and its tax ID in the U.S., if there is one.

- Form 5000 non-certified.

Other U.S. resident entities:

- A certificate of residence in one of the following forms (mandatory):

The above-mentioned certificates of residence remain valid for the fiscal year only and must be provided annually.- An IRS Form 6166, duly completed and certified by the IRS, replacing the Form 5000 in this case; or

- A Form 5000 duly completed and certified by the U.S. intermediary in Box VI; or

- A Form 5000 duly completed and certified by the IRS in BOX IV.

Note: The original certificate of residence must, in all cases, be provided to LuxCSD at least one business day before the first dividend payment date to which it applies, by 09:00 CET.

- Per-payment Corporate Action Instruction, if applicable;

- Per-payment Detailed List of Beneficial Owners, if applicable.

French residents (direct clients)

- One-Time Certificate - French clients;

- Power of Attorney, when applicable;

Form descriptions are presented according to the procedures available for relief or reclaim of withholding tax on income from French equities.

Deadlines for receipt of documents

Documentation for relief at source from withholding tax on dividends from French equities through the simplified procedure must be received by LuxCSD by the following deadlines:

One-Time Certificates | At the latest, on record date minus one business day of the first dividend payment date to which it applies, by 09:00 CET. |

Form 5000 Certificate of Residence | |

Form 5000 Attestation of Percentage | |

Form 5001 Calculation of Withholding Tax on Dividendsa | |

Self-certification for qualified European Parent Companies | |

RPPM form and decision letter from DINR (non-EU CIV) | |

One-Time Attestation Article 131 sexies and DLF agreement letter | |

Non-Profit Organisations Certificate | |

GBR Attestation | |

GBR cover letter | |

Per-payment Detailed List of Beneficial Owners | Generally, at the latest 45 calendar days following the dividend payment date by 09:00 CET. |

Corporate Action Instruction | At the latest, on the record date of each relevant dividend payment, either via Xact Web Portal, CreationOnline (CBL and CEU 6-series account clients only) or by a formatted SWIFT MT565 message, by 09:00 CET. |

a. For EU parent companies, (page 1 only).

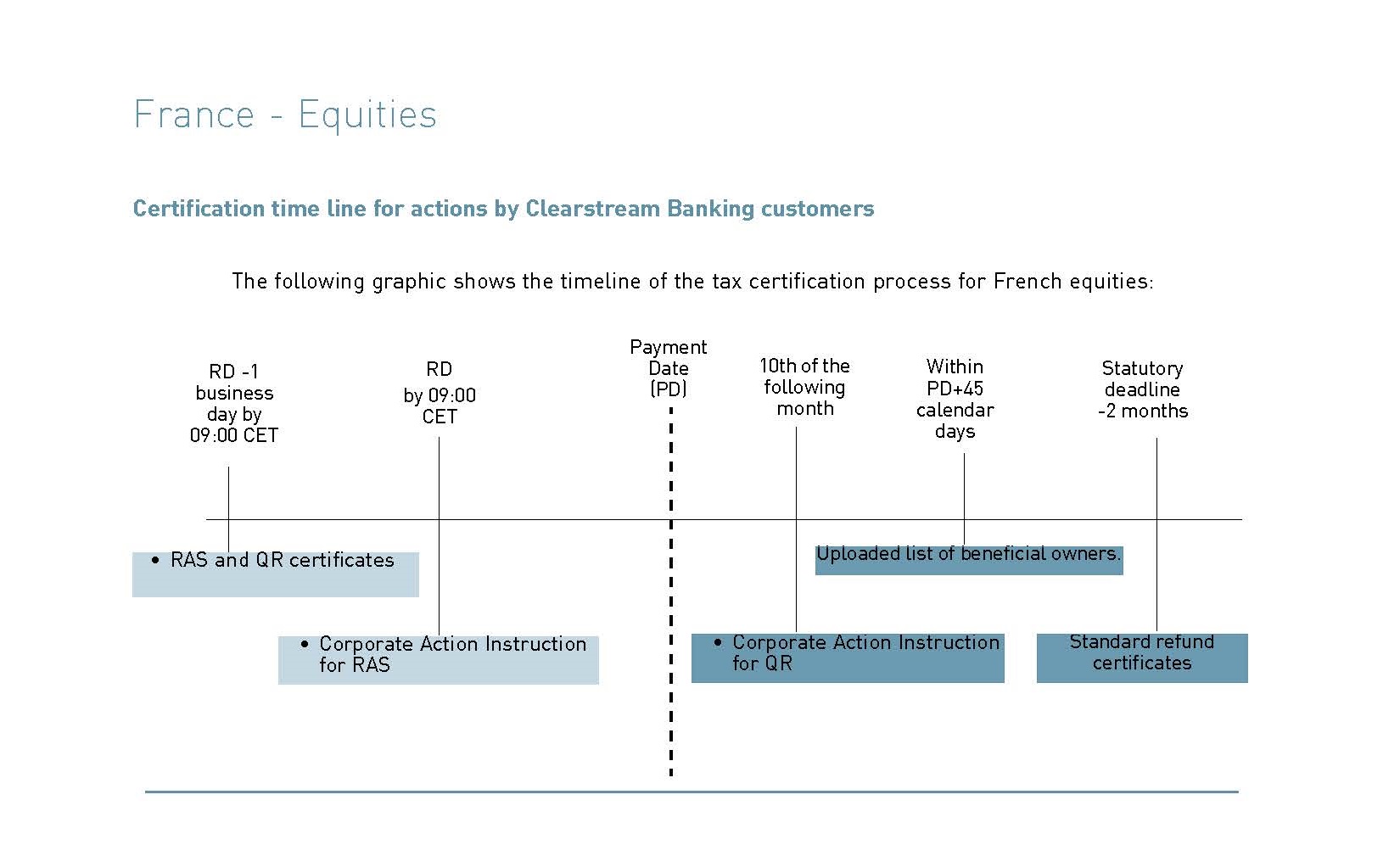

Certification timeline for actions by LuxCSD clients:

Click on the image to view the diagram showing the timeline for actions by LuxCSD clients.

Notes on the List of Beneficial Owners

When required, the list of beneficial owners must, in general, be received no later than 45 calendar days after the payment date.

Beneficial owner certification must provide the following details per beneficial owner:

- Full name;

- Address for tax purposes, including street address, postal code and country;

- Tax identification number (TIN), if any;

- Legal status of the beneficial owner;

- Quantity of the securities held;

- ISIN of the securities held.

Important note:

If the beneficial owner type used in this spreadsheet does not match the BO type used in the “Occupation” field of Form 5000, relief may not be granted and the payment may, as a consequence, be reversed.

It is recommended to avoid using “legal entity” and “Investment fund” status.

Beneficial Owner Lists must be supplied in the correct format. The list of beneficial owners must be uploaded online via the Clearstream website, as follows:

- On the Clearstream website, go to the Upload BO List page.

- Click on the hyperlink text “upload Beneficial Owner (BO) Lists”.

- Having entered your password successfully, select France from the dropdown market list.

- To download the required template for completion, click on the appropriate security type in the area labelled “B.O. List templates”.

- In the open spreadsheet file, enter off-line the details of one or more beneficial owners and their respective income payments.

- Save the completed file, in comma-delimited format (CSV), to a preferred location in your own file system.

When you have completed and saved the list, you must return to the BO List/France page and: - Click on the appropriate security type.

- Read and Accept the Acknowledgement and Legal Disclaimer text.

- Enter your upload details and then browse for and select for upload the CSV-format file that you saved in step 6 above.

- Verify the final details.

After verification, a reference number is assigned that you should record for tracking purposes. The full details of the upload can be printed at this point.

A confirmation email is also sent containing the basic details of the upload. (Confidential data is not sent in the email.)

When is relief at source received?

LuxCSD clients receive relief at source in two steps:

- On payment date, the reduced Double Taxation Treaty (DTT) dividend withholding tax rate and the Dividend Credit Adjustment (DCA) - if this has been announced before the payment date - are applied.

- The remaining DCA is received when the distributing company makes public the amount of their Crédit d'Impôt Etranger (CIE). This may occur at the payment date, but generally occurs after the payment date.

Explanation and example of the payment of dividends and DCAs due to foreign tax credit (CIE):

Note: For the example, a dividend payment of 2.00 is used and a DCA fixed to 0.01429.

First Payment | Dividend at 75% | = total quantity of shares * 75% of the unit price = 2,000 * 75% * 2.0 = 3000 |

Second Payment | DCA-CIE at 75% | = total quantity of shares * 75% CIE = 2,000 * 75% * 0.01429 = 21.435 |

Refund of tax | = 21.435% of the payment = 4,000 * 21.435% = 857.44 |

Thus, the beneficial owner will receive, via the Form 5001, a refund of 21.435% of the payment for a holding of 2,000 shares with a dividend of EUR 2, which is an amount of 857.4.

A non-resident investor is entitled to the DCA-CIE, which is also paid at 75%, but the tax refund of 10% will be automatically processed.

Refund of 20% CIE | = total quantity of shares * 21.435% CIE = 2,000 * 21% * 0.01429 = 6.13 |

Thus, the total amount of the refund would be: 857.4 (Dividend) + 6.13 (DCA-CIE) = 863.53.

Clients should submit a reclaim for a refund of 863.53 specifying the amount of DCA-CIE.