LuxCSD Default Management

1. LuxCSD Default Management Process

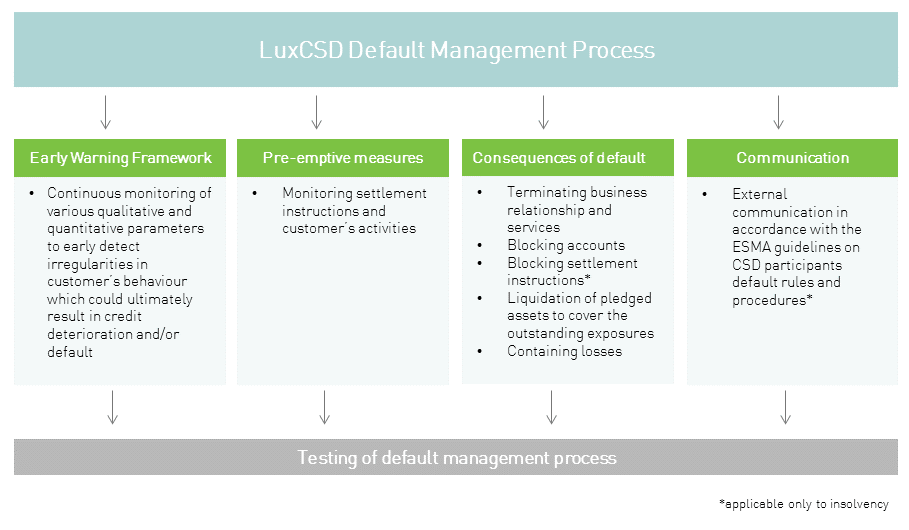

The default management process of LuxCSD has been implemented to mitigate the risks arising from the default of a LuxCSD customer and enables LuxCSD to avoid and minimise losses related to a customer default. The non-defaulting customers of LuxCSD also benefit from the default management process as its purpose is to manage a customer default in a prudent and orderly manner, limiting disruptions to the market and avoiding changes to the normal settlement practices of non-defaulting LuxCSD customers.

Important note: The process described hereafter is the general approach to handle a default in accordance with the Principle 13 of CPSS-IOSCO and article 41 (1) of the Regulation (EU) No 909/2014 on improving securities settlement in the European Union and on central securities depositories (hereinafter “CSDR”). It does not override the contractual agreements (GTCs and/or bilateral agreement(s)) in place with the customer.

2. Overview of LuxCSD Default Management Process

The default management process of LuxCSD has been implemented in accordance with the Principle 13 CPSS-IOSCO and CSD-Regulation and can be summarised as follows:

According to the Article 41 (2) of CSDR, the LuxCSD Default Management presented here is part of the relevant default rules and procedures that should be made available to the public.

2.1 Early warning framework

The Early Warning Framework is an important component of the LuxCSD default management process. It includes the continuous monitoring of defined indicators and their thresholds in order to ensure an early detection of irregularities in customer’s behaviour, which could ultimately result in customer’s credit deterioration or default.

2.2 Pre-emptive measures

In order to mitigate the risks resulting from arising customer default, LuxCSD has various pre-emptive measures that can be implemented. These include mainly a close monitoring of settlement instructions and affected customer’s activities. At the same time, the level of communication with the affected customer would increase as well as the monitoring of all sources of information (e.g. press, rating agencies, etc.).

2.3 Default

2.3.1 Types of default

LuxCSD defines two types of default:

- General default: A customer is unable to fulfil its contractual obligation according to an agreement with LuxCSD where insolvency proceedings, as defined in point (j) of Article 2 of Directive 98/26/EC on settlement finality in payment and securities settlement systems, as amended (“Settlement Finality Directive”), are opened against a customer (”insolvency proceedings” shall mean any collective measure provided for in the law of a Member State, or a third country, either to wind up the participant or to reorganise it, where such measure involves the suspending of, or imposing limitations on, transfers or payments);

- Contractual default: A customer is unable to fulfil, in a timely manner, one or more of its scheduled contractual obligations according to an agreement with LuxCSD.

2.3.2 Acknowledgement of customer default

The default rules and procedures are implemented once a customer default (insolvency/bankruptcy, liquidation, reorganisation, or any other proceeding seeking similar relief with respect to the customer or their debts) is identified and all reasonable actions are taken to verify its occurrence. The communication of default to LuxCSD may be done by the customer itself, a competent authority, or any other entity with knowledge of the existence of the default. To this end, LuxCSD customers are requested to notify LuxCSD of their default in accordance with the LuxCSD GTCs in writing or electronically to cslux@luxcsd.com as soon as possible. Following that, LuxCSD will transmit this information along with its source to its competent authorities.

2.4 Consequences of default

2.4.1 Terminating business relationship and services

A default could trigger a termination of business relationship and services. LuxCSD may terminate the complete business relationship, individual business connections or the performance of particular services. A reason for termination is, inter alia, if a customer no longer meets one or more LuxCSD’s criteria for participation, and/or the participation of a customer materially impairs the LuxCSD system, the interest of LuxCSD or any other customers, including in particular, the financial position of the customer is threatened or customer is in breach of any obligation incumbent upon him under the governing documents or any other agreement with LuxCSD. The Executive Committee of LuxCSD will decide on case-by-case basis whether the business relationship should be terminated.

2.4.2 Blocking accounts

In case of a customer default, LuxCSD may have the right to block customer’s accounts subject to certain conditions pursuant to the GTCs. The decision to block an account is made by the Executive Committee of LuxCSD or upon instruction from an authority/regulator.

2.4.3 Blocking settlement instructions

In order to ensure protection of settlement for non-defaulting customers, the transactions of defaulting customers may be suspended from automatic transaction processing, to the extent permitted by law and according to the contractual agreements in place between LuxCSD and the customer. All transactions will then be manually monitored. In the specific case of customer insolvency, the handling of pending settlement instructions is undertaken according to the rules of the Settlement Finality Directive as presented in the attachment below.

2.4.4 Liquidation/containing losses

Once a customer default occurs, liquidation is undertaken with the objective of closing the outstanding exposures and containing potential losses.

According to the right of pledge under the GTCs, LuxCSD has the right to select the pledged assets to be liquidated. If difficulties to liquidate any of the selected pledged assets arise, these can be replaced by alternative securities from the customer account.

2.5 Communication

In accordance with the ESMA guidelines on CSD participants default rules and procedures, LuxCSD will notify as soon as possible its competent authorities and the defaulting customer of the actions to be taken or taken following a default (related to the insolvency or similar proceeding of a customer), and will also inform, as soon as possible:

- its relevant authorities;

- ESMA;

- its non-defaulting participants;

- the trading venues and CCPs served by the CSD;

- the operator of the common settlement infrastructure used by the CSD;

- the linked CSDs.

LuxCSD will also increase the communication with the impacted customer in order to ensure the highest level of transparency as possible.

3. Governance

The default management process is maintained by the Default Management Unit and regularly reviewed and approved by the Board of Directors of LuxCSD. In case of a crisis/customer default, the default management process is governed by the Executive Committee. The Executive Committee may decide to handle the crisis in a flexible way, where necessary, therefore the actions taken in case of default are not automatic but decided on case-by-case basis taking into consideration among other factors the size of outstanding exposures and market risk.

4. Testing

Default management testing is an integral part of LuxCSD default management process. For the purpose of continuous improvement, the default management process is tested at least annually, involving all relevant stakeholders. The tests are also performed following any substantive changes to the default rules and procedures or upon request from the regulators. The results of any relevant test and any significant change to the default rules and procedures are reported to the respective Executive Committee of LuxCSD, the risk committee and the competent authorities. A summary of the results and contemplated changes to the default rules and procedures are regularly published on this website and as such accessible to all LuxCSD customers. Should a test highlight any weaknesses in the default rules and procedures or in their implementation, appropriate actions will be taken to remove such weaknesses.

LuxCSD offers customers the opportunity to be involved in the LuxCSD default management framework by going through LuxCSD’s default rules and procedures as well as the testing activity. The purpose is to enhance the general awareness of default management and get feedback from customers on the default rules and procedures in order to further improve the default management process. For further information, customers may contact their Relationship Officer.