Settlement Discipline Regime (SDR): Information on reporting, collection and distribution of penalties

Note: This announcement, originally published on 22 February 2022 has been updated to provide information on Bridge penalties calculated by EB and CBL. Customers are also reminded to consider the information about adding or changing the report scheduling mentioned in the section "Reporting of cash penalties". Changes have been highlighted.

Cleaning of penalties from the database

Since July 2021, Clearstream Banking1 customers have benefited from both a testing and dry-run environment to prepare for the new Settlement Discipline Regulation.

All penalties:

- Calculated on, or after 1 February 2022 (as reported in field :98A::DACO// in Sequence D1 of MT537 PENA); and

- Applicable on 1 February 2022, and/or future business days (as reported in field :98A::PEDA// in Sequence D1a1A of MT537 PENA)

are subject to collection and distribution.

Penalties calculated in February 2022 are to be collected, or distributed, on 23 March 2022.

Handling of penalties calculated during the dry-run

All penalties calculated prior to 1 February 2022 (excluded) will not be collected or distributed.

In addition, Clearstream Banking is cleaning all those penalties (T2S, CBL internal, Bridge, and domestic) from its database:

- Penalties calculated on or before 30 November 2021 (subject to monthly reporting in December 2021) have been removed from the database on 1 February 2022;

- Penalties calculated in December 2021 (subject to monthly reporting in January 2022) will be removed from the database on 25 February 2022.

Note: Penalties calculated in January 2022 (subject to monthly reporting in February 2022) will remain in the database, but will not be subject to any collection and distribution.

Penalties calculated by Clearstream Banking S.A. (CBL) and by Euroclear Bank (EB)

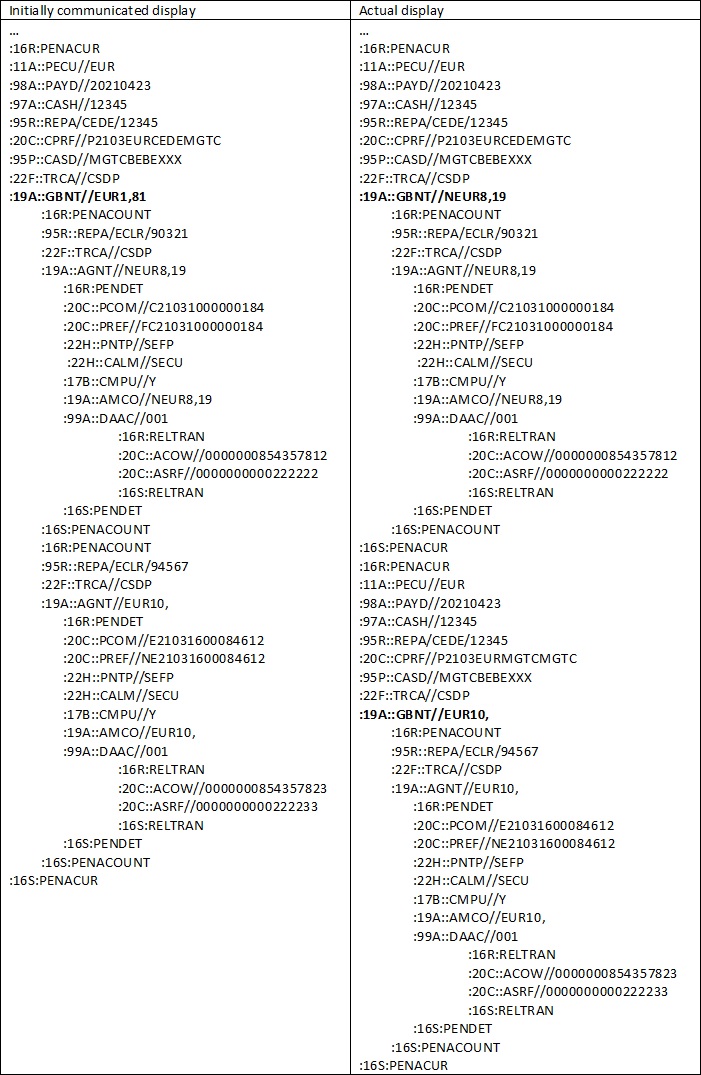

Contrary to what was initially communicated to customers in August 2021 (CSDR Settlement Discipline Cash Penalties - Samples of Daily and Monthly MT537 reporting of cash penalties from CBL), the MT537 Daily Report and the MT537 Monthly Aggregated Report will not net the Bridge penalties calculated by Euroclear Bank (EB) with the Bridge penalties calculated by CBL. For the collection and distribution, two PFOD instructions will be generated, one for the global net amount of all Bridge penalties calculated by CBL, and one for the global net amount of all Bridge penalties calculated by EB, instead of just one PFOD instruction for all Bridge penalties.

As of 13 June 2022, all Bridge penalties calculated by EB and CBL will be netted and reported in the same sequence D1 PENACUR of both MT537 Daily and Monthly Aggregated reports.

Illustration

Clearstream Banking assumes the following cash penalties for March 2021 for CBL customer 12345 for Bridge transactions (counterparty is an EB customer):

- One SEFP, CBL customer 12345 has to pay 8.19 EUR to EB participant 90321, calculated by CBL on 10 March 2021;

- One SEFP, CBL customer 12345 has to receive 10.00 EUR from EB participant 94567, calculated by EB on 16 March 2021.

The CBL customer 12345 should have received one MT537 Monthly Aggregated Report, including one positive Global Net Amount equal to 1.81 EUR.

Instead, the CBL customer 12345 will receive one MT537 Monthly Aggregated Report, including two Global Net Amounts:

- One for Bridge penalties calculated by CBL (equal to -8.19 EUR in this scenario); and

- One for Bridge penalties calculated by EB (equal to 10.00 EUR in this scenario).

This results in twice the same sequence D1 in the same MT537 Monthly Aggregated Report.

To enlarge click on the image

Penalties reported in February 2022 and subject to collection and distribution in March 2022

Since the Settlement Discipline Regulation came into effect on 1 February, a number of system defects have been identified either in Clearstream Banking or with its local providers. These defects have resulted in some penalties not having yet been reported to customers.

Fixes will be implemented over the course of February and missing penalties will then be reported to customers in their daily MT537 report. These penalties will also be part of the monthly MT537 report and will be taken into account for the collection and distribution in March 2022.

Reporting of cash penalties

Clearstream Banking reports cash penalties, including details on the calculation and the related settlement instruction, on a daily basis via ISO 15022 MT537. New and amended cash penalties are reported in two separate messages.

The daily reports are delta reports, which include changes only compared to the previous report. More specifically:

- The report including new cash penalties will only contain new cash penalties calculated or received from T2S/depositories since the last report.

- The report including amended cash penalties will only contain amendments to cash penalties processed by Clearstream Banking or received from T2S/depositories since the last report.

If for a given time scheduled by the customer, there is no new cash penalty to be reported, then the customer will receive a “no activity” report. Likewise, if there is no amendment to be reported, the customer will receive a “no activity” report.

These reports are not sent automatically but must be scheduled by the Clearstream Banking customer via Xact Web Portal. Clearstream Banking customers can select between 13 different times to receive their daily reports. The times available are:

- 08:30 CET;

- 09:30 CET;

- 10:30 CET;

- 11:30 CET;

- 12:30 CET;

- 13:00 CET;

- 13:30 CET;

- 14:30 CET;

- 15:30 CET;

- 16:00 CET;

- 16:30 CET;

- 17:00 CET; and

- 18:00 CET.

Currently, if the scheduling to receive MT537 daily penalty report is amended in Xact Web Portal, there is the risk that some daily reports may not be generated. Therefore, Clearstream Banking will add a new end of day (21:15 CET) intraday batch and will make it mandatory to ensure customers receive a complete reporting of their penalties.

This “end of day” report will be released systematically upon subscription to any of the above-mentioned available intraday reporting batches. Before changing the scheduling, customers are recommended to contact the Clearstream Banking connectivity team for guidance. Further information will be communicated when this mandatory release will apply.

Note: For more details on the content of the MT537 on cash penalties and samples please refer to the documents on the website.

Further information

For further information, customers may contact Clearstream Banking Client Services or their Relationship Officer.

----------------------------------------------------------------

1. Clearstream Banking refers collectively to Clearstream Banking S.A., registered office at 42, avenue John F. Kennedy, L-1855 Luxembourg, and registered with the Luxembourg Trade and Companies Register under number B-9248, and Clearstream Banking AG, registered office at 61, Mergenthalerallee, 65760 Eschborn, Germany and registered in Register B of the Amtsgericht Frankfurt am Main, Germany under number HRB 7500.