Spain: First phase of market Reforma – Further information and cutover details

Following our previous announcement L15193, published on 18 December 2015, about the adaptation of Clearstream Banking’s1 settlement system for equities on the Spanish market, effective requested settlement date

2 May 2016

Clearstream Banking would like to inform customers about the impact on Spanish regional securities, the adaptations of the transaction management process and the cutover details for the listed equities, including regional securities, ETFs and warrants.

Spanish regional securities

Spanish regional equities, currently within the SCL Barna Deuda and the SAC Bilbao platforms, will be migrated to the Iberclear’s new platform, ARCO on the above effective date.

Other Spanish regional securities such as bonds are not impacted by the first phase of market Reforma and will continue to settle on SAC Bilbao (Euskobonos) and SCL Barna Deuda. The date when these bonds will migrate to Iberclear’s platform CADE for the interim period (between Reforma phase 1 and Iberclear migration to T2S) has not yet been confirmed.

Transaction Management

In line with the Corporate Actions Joint Working Group (CAJWG) as well as best market practices, market claims and transformations (together referred to Transaction Management) will be processed automatically by Iberclear and will require no input from the customer. Both will be confirmed via MT566 to customers.

Market Claims

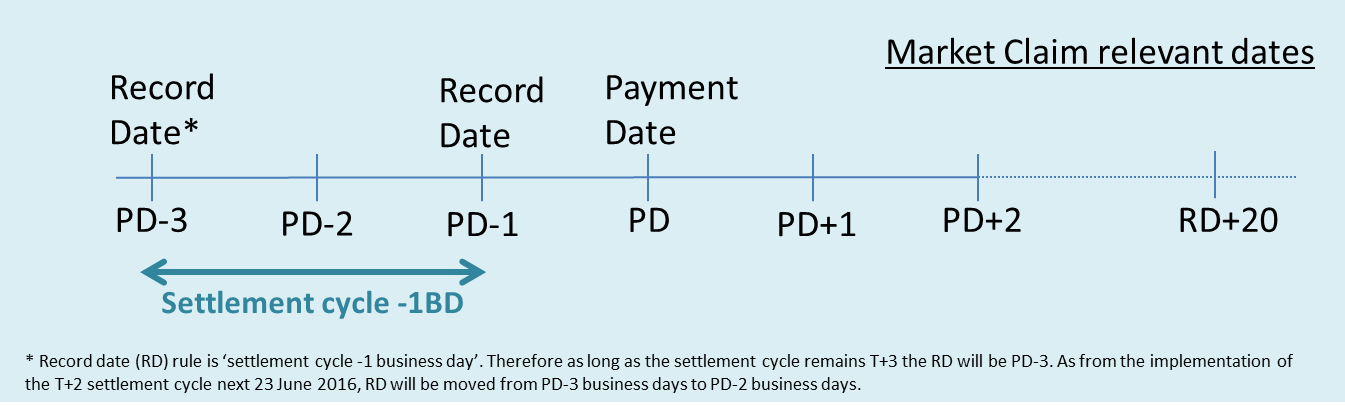

Market claims in cash and in securities for instructions in Iberclear’s new platform, ARCO, will be detected and processed by Iberclear and subsequently by Clearstream Banking at the end of the record date and during the following 20 business days.

Compensation credits/debits, whether in cash or in securities, will be reported to customers via MT566 with indicator :22F::ADDB//CLAI (or Additional Business Process: Claim within CreationOnline).

The corporate action cycle will be updated as follows and in accordance with the change to the ExD for Spanish equities, from PD to PD-3.

Market claims will have their own lifecycle once matched (via Already Matched instructions) and will settle independently from the underlying settlement instruction.

Although no action is required from customers of Clearstream Banking, in case of bilateral cancellation of the underlying settlement instruction, Clearstream Banking customers will need to agree directly with their counterparty about the reversal or the cancellation of the associated market claim.

Tax treatment of Cash Market Claim

Cash market claims will no longer be done on a net basis, but will be debited and credited on a gross basis by Iberclear, regardless of the initial income payment which will continue to be processed on a net basis in accordance with the tax certification in place.

The market will offer no tax reclaim possibilities on cash market claims. As a result and in line with local market practice, Clearstream Banking will process the cash market claims on a gross basis and will not accept tax reclaims for those. Customers must make arrangements directly with their counterparties if the applicable tax rate differs.

Market claims rules applicable to internal transactions remain unchanged. Clearstream Banking will continue to process internal compensation on a net basis. Clearstream Banking can give no guarantee that the tax applied on these transactions can be recovered from the Spanish Tax Authorities, because of the above explained market restriction.

Transformations

Transformation is the process by which pending transactions still unsettled by the end of Record Date/market deadline are cancelled and replaced in accordance with the terms of the reorganisation event.

Transformation will be introduced and automatically processed by Iberclear. The transformation will be processed by Iberclear in two technical steps: the cancellation of the underlying transaction followed by the replacement by one or several new transformed instructions.

Clearstream Banking will cancel and replace customers’ pending settlement instructions based on feedback received from the market. Outturn in cash and securities will be posted to customers’ accounts and reported in the MT950, MT9xx, MT54x and MT536 reports.

- Unmatched transactions will be cancelled.

- Unsettled matched transactions will be cancelled and replaced by other matched transactions in accordance with the terms of the reorganisation and under the same conditions of the underlying transaction.

Cancellation - MT548

:24B::CAND/CANT

:20C::RELA/reference of the instruction to be transformed

:20C::CORP/reference of the related corporate action

- Upon completion of the replacement settlement instructions in the domestic market, Clearstream Banking will credit/debit the proceeds onto the account(s) of the customer and confirm via MT566.

Buyer Protection

Iberclear will offer buyer protection services for transactions clearing through the CCP only.

The buyer protection mechanism will be manual via a bilateral agreement between the respective counterparties by means of a manual process (no intervention of the market infrastructure regarding the exchange of buyer protection instructions).

Iberclear will handle the execution of the buyer protection and take action on the underlying transaction (Hold / cancellation / transformation).

As a result, Clearstream Banking will be processing the buyer protection whenever executed by Iberclear and on a “best efforts” basis only.

Official Corporate Action Event Reference

For corporate action events, the Official Corporate Action Event Reference will be included in all messages related to an event as described below:

| Field content | Creation via SWIFT and CreationDirect | CreationOnline |

| Reference of Corporate Action Event | :20C::COAF | Official Corporate Action Event Reference |

Cutover details

Settlement instructions with requested settlement date (SD) up to and including 29 April 2016

Clearstream Banking customers must send their instructions using the current format and no later than 17:00 CET on Friday 29 April 2016 or by the applicable deadline if earlier.

Matched instructions will settle on the applicable SCL, SAC Bilbao or SCL Barna Deuda platform.

Unmatched instructions that remain pending at the end of their respective settlement cycle will be cancelled and customers will be informed accordingly by MT548. Customers will need to re-instruct using the new attached format no earlier than 08:00 CET on Sunday 1 May 2016. These instructions will be settled on the new platform ARCO.

Settlement instructions with SD 2 May 2016 and later

Clearstream Banking customers must send their instructions using the new format, no earlier than 08:00 CET on Sunday 1 May 2016.

Instructions will be settling on Iberclear’s new ARCO platform and processed following the Reforma phase 1 rules.

New formatted instructions received earlier than 08:00 CET on Sunday 1 May 2016 will be cancelled and customers will be informed accordingly by MT548. As of 08:00 CET on Sunday 1 May 2016, customers will need to re-instruct.

Income and custody events

There is no impact on income events (interest or dividend) on securities moving to Iberclear's new platform ARCO.

A change in the corporate action cycle will take place on 27 April 2016. Therefore corporate events with record date (RD) value 26 April 2016 and ex date and payment date up to and including 27 April 2016 will be processed under the current rules.

Corporate events with value date 3 May 2016 will be the first events to be processed under the new procedure established by ARCO, where the ex-date equals payment date (PD) -3 and RD is equal to PD-1.

There will be no cash payment on the 28 April 2016, 29 April 2016 or 2 May 2016 (there will be no PD on those dates).

No action is required from Clearstream Banking or its customers.

Further information

For further information, customers may contact Client Services or their Relationship Officer.

-----------------------------

1. Clearstream Banking refers collectively to Clearstream Banking AG, registered office at 61, Mergenthalerallee, 65760 Eschborn, Germany and registered in Register B of the Amtsgericht Frankfurt am Main, Germany under number HRB 7500, and Clearstream Banking S.A., registered office at 42, avenue John F. Kennedy, L-1855 Luxembourg, and registered with the Luxembourg Trade and Companies Register under number B-9248.