Settlement process in T2S

T2S Party identification

A party identification in T2S will always be based on the BIC11 of the T2S participant plus the BIC11 of the respective CSD/National Central Bank (NCB) entity (that is, the CSD or NCB where the party was opened in T2S).

T2S Settlement accounts

T2S uses BIC Branch Codes to identify settlement accounts. On T2S each CSD participant is identified by the BIC of its CSD plus its own BIC. A financial institution having a relationship with different CSDs and NCBs will be defined several times as a party. For example, a bank having a relationship with two different CSDs and one NCB will be recognised as three parties in T2S (that is, at least as a participant for each CSD and as a payment bank for the NCB).

T2S cash accounts for settlement

Cash settlement in T2S eligible currencies (at the moment only Euro) will be processed via Dedicated Cash Accounts (DCA) in T2S. The funding of these DCAs will be done from the RTGS accounts in TARGET2. In order to participate in Delivery – versus – Payment (DvP) settlement, T2S participants need to link their T2S SAC to at least one DCA via a NCB. The DCA number will be provided by the NCB.

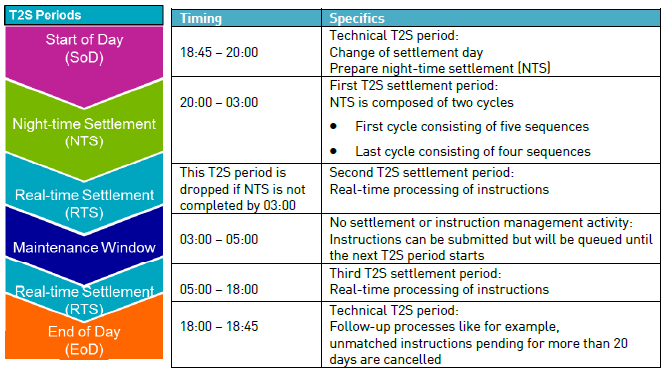

T2S Settlement periods

Any settlement activity in T2S takes place within six different T2S periods. Two of these T2S periods – Start of Day preparation from 18:45 CET to 20:00 CET on SD-1 and End of Day processing from 18:00 CET to 18:45 CET – are reserved for automated technical processes preparing for or following up on the settlement day.

Securities settlement takes place in three T2S periods:

Night-time settlement

Night-time settlement (NTS) runs from 20:00 CET on SD-1 until at the latest 03:00 CET on SD. NTS is divided into two cycles – the first cycle and the last cycle. The first cycle is subdivided into five sequences and the last cycle into four sequences. Within the different sequences certain transactions or certain instruction types settle.

At the end of the last night-time settlement cycle (as of sequence X), T2S submits, for partial settlement, all eligible transactions that failed to be settled in an earlier attempt during the night.

Real-time settlement over night

The overnight T2S real-time settlement period (RTS) starts directly after the end of NTS. If NTS is not completed by 03:00 CET, this T2S RTS period will be skipped as, in this case, the T2S maintenance period will follow right after the end of the NTS.

Real-time settlement during the day

The daytime T2S real-time settlement period opens directly after the end of the T2S maintenance period at 05:00 CET and runs throughout the business day until 18:00 CET.

Between the two T2S real-time settlement periods, T2S interrupts any settlement or booking activity for another T2S period for maintenance purposes.

Partial settlement takes place at 08:00 CET, 10:00 CET, 12:00 CET, 14:00 CET and 15:30 CET.

Live cycle management and matching in T2S

Life cycle management and matching consists of four main processes (business validation, instruction maintenance, matching, and settlement eligibility).

Business Validation

Validation is the process of checking the consistency of instructions sent to T2S. These consistency checks ensure that the incoming instruction is consistent with T2S static data. After validation, the status of the instruction is either “accepted” or “rejected”.

Instruction maintenance

Instruction maintenance consists of instructions to amend, cancel, hold or release a settlement instruction. The amendment of process indicators is possible until settlement or cancellation. Any T2S party may cancel its instructions unilaterally prior to matching. Once matching has occurred, T2S parties can cancel instructions only bilaterally, that is, both parties must send a cancellation instruction (“binding matching”) for the cancellation to take effect. T2S will provide hold and release mechanisms. T2S parties and CSDs can use these mechanisms on a voluntary basis. These mechanisms allow T2S parties and CSDs to hold or release instructions prior to settlement.

Matching

T2S provides real-time matching facilities throughout the operating day (except for maintenance windows). Following a matching attempt, the instruction is given the status “matched” or “unmatched”. T2S provides information to the instructing parties on the result of the matching process. Instructions may enter T2S either as “to be matched” or as “already matched”.

Matching rules

The following criteria are mandatory for free of and against payment instructions in T2S:

• Payment type;

• Securities movement type (values match opposite);

• ISIN code;

• Trade date;

• Settlement quantity;

• Intended settlement date;

• Delivering party BIC;

• Receiving party BIC;

• CSD of delivering party; and

• CSD of receiving party.

For against payment transactions, the following criteria are also mandatory:

• Currency; and

• Settlement amount.

Recycling of pending transactions in T2S

Unmatched instructions will be cancelled automatically either after 20 working days starting from the intended settlement date or the date of the last status change of the instruction.

Matched, but not settled instructions will be cancelled by T2S after 60 business days (starting from the date of receipt or on the day the last modification was sent for this instruction).

Cash liquidity and security need to be available on a gross basis for the real-time settlement, that is purchases and sales between the same counterparties will not settle if one of them does not have the respective securities or cash. For the night-time settlement netting is available.

Bilateral cancellation in T2S

This means that matched instructions can only be cancelled if both domestic counterparties request a cancellation of their instructions.

Until the cancellation confirmation is received from the market, the instruction will remain eligible for settlement, that is, the instruction may be provisioned and proposed for settlement and may be subject to cash penalties.

Hold and release

The hold and release mechanism enables customers to temporarily hold back a securities transaction from domestic settlement, even if cash or securities provision is available and to release it to the domestic market only when settlement is desired. The matching process applies independently of the “hold and release” status of the instruction.

Partial settlement in T2S

Partial settlement is available for domestic transactions and the customer’s decision to accept for the transaction to settle/not to settle partially will be systematically included in the instruction sent to the local market.

Cash tolerances

For domestic instructions against payment in EUR, the following cash tolerance levels will apply:

- EUR 2 for transactions of an amount up to or equal to EUR 100,000; and

- EUR 25 for transactions of an amount greater than EUR 100,000.

Cash penalties

Penalties will be calculated and applied on matched settlement instructions that fail to settle, in full or in part, on and after their intended settlement date (ISD), if both the settlement instruction and the relevant financial instrument are subject to cash penalties.

Instruments subject to cash penalties

Any financial instrument listed in the Financial Instruments Reference Data System (FIRDS) database maintained by ESMA will be subject to cash penalties. However, cash penalties will not apply to shares listed in the Short Selling Regulation (SSR) exemption listed in the Short Selling Regulation (SSR) exemption list.