Equities - rates, eligibility, availability of relief etc. - Portugal - securities held in CBF

Withholding Tax

Standard rate of withholding tax: | 35% | Holding requirements / restrictions: | No |

Availability of relief

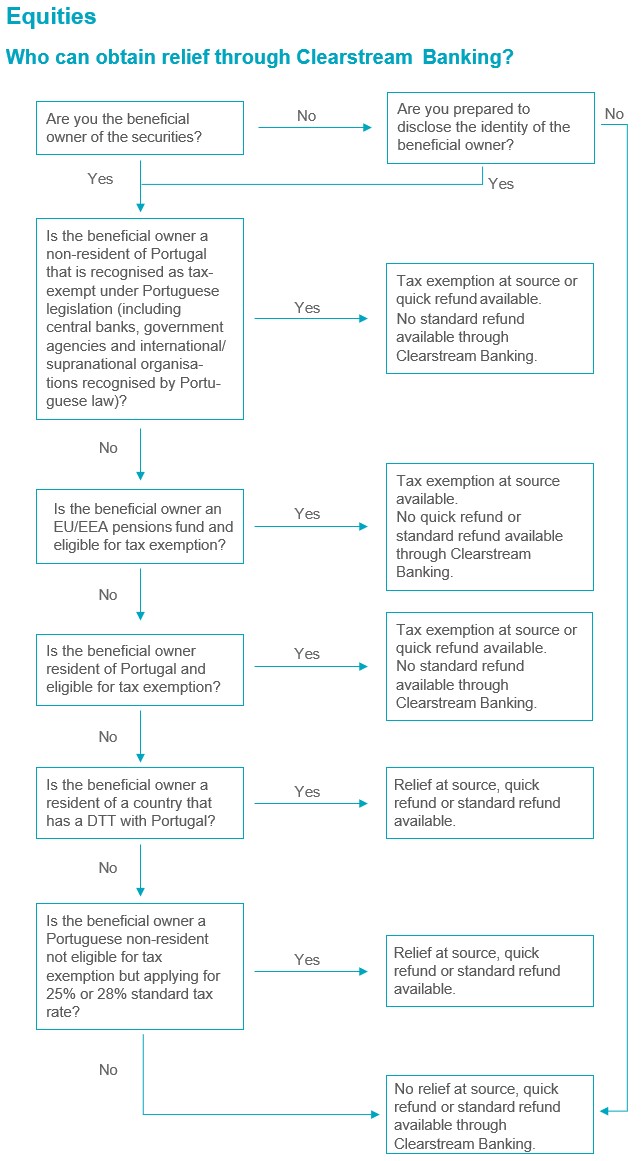

The type of tax relief (full/partial) varies according to the residence and status of the final beneficial owner, as follows:

Eligible beneficial owners | Relief at source | Quick Refund | Standard Refund |

Residents of a Double Taxation Treaty (DTT) country | Yes | Yes | No |

EU/EEA pension funds | Yes | Yesa | No |

Non-resident of Portugal availing themselves the privileges and immunities enshrined in an international agreement or chart (central banks, government agencies and international/supranational organisations recognised by Portuguese law | Yes | Yes | No |

Non-residents of Portugal recognised as tax-exempt under Portuguese legislation (including Central banks and government agencies, International/Supranational organisations recognised by Portuguese law) | Yes | Yes | No |

Non-resident of Portugal or DTT country applying for a reduced tax rate (25% or 28% rate) Yes Yes | Yes | Yes | No |

Portuguese residents eligible for tax exemption | Yes | Yes | No |

Portuguese residents applying for a reduced tax rate (25% or 28% rate) | Yes | Yes | No |

a. EU/EEA pension funds can only apply for a partial quick refund

Relief at source of withholding tax is available only if the appropriate documentation is submitted to LuxCSD.

A quick refund is available if a relief at source has not been obtained by the eligible beneficial owner, except for EU/EEA pension funds.

The standard refund on equities on dividends paid as of 14 December 2020 is currently not available. The process is under review with the Portuguese tax authorities. Additional information will be published when received.