Luxembourg: Immobilisation of bearer shares and units issued by Luxembourg companies

To adapt legislation to the recommendation of the Financial Action Task Force (the FATF) and the Global Forum on transparency and exchange of information for tax purposes, the Luxembourg Parliament has revised the legal regime applicable to bearer shares and units issued by Luxembourg companies and adopted a law on their immobilisation (the Law), which entered into force on 18 August 20141.

Scope of the Law

1. Impacted types of financial instruments

The new regime applies to bearer shares and units, whether listed or not, issued by Luxembourg companies only, under the form of S.A. or S.C.A., including fund units of SICAVs, SICARs, FISs and FCPs whose management companies issue bearer units in accordance with the law of 17 December 2010.

The Law applies to existing bearer shares and units and those that may be issued after the entry into force of the Law.

All provisions of the Law are applicable as of 18 August 2014. A transition period is, however, provided for existing bearer shares and units (see sections 3. and 4. below).

Note: Bearer bonds are excluded from the scope of the Law.

2. New mechanism: immobilisation of bearer shares/units with a depository

The Law introduces a mandatory immobilisation of bearer shares and units with a depository that meets the following requirement:

- It is established in Luxembourg;

- It is subject to anti-money laundering obligations; and

- It is not a shareholder of the company.

The depository must be a professional of one of the following categories:

- Credit institution;

- Asset manager;

- Distributor of UCI shares;

- Certain specialised professionals of the financial sector;

- Lawyer;

- Auditor;

- Accountant; or

- Notary.

The designated depository has the obligation to open and keep up-to-date a dedicated register containing the following information necessary for the identification of the owners of the bearer shares/units:

- Complete designation of each owner of the bearer shares/units with an indication of the number of shares/units;

- Date of deposit of the shares/units;

- Relevant details and dates of transfers or conversions.

The information about the holders of the bearer shares/units is accessible to:

- The competent Luxembourg authorities; and

- Each holder of bearer shares/units (restricted to records of its own positions).

Immobilised bearer shares/units cannot be transferred out by the depository except in special circumstances defined by the Law in its article 6 (for example, transfer to another depository at termination of its mandate; conversion of the shares/units into registered form shares).

The holding of bearer share/unit certificates will no longer be taken as proof of ownership of such shares/units under Luxembourg Law. Such ownership shall be evidenced by a registration in a dedicated register.

The issuance of a certificate of immobilisation may still be delivered by the depository designated by the issuer upon request of a shareholder. Such certificate confirms that the bearer shares/units have been registered in the share register and immobilised within the meaning of the Law. However, such certificate will not be considered as proof of ownership of the bearer shares/units.

3. Obligations for the issuers

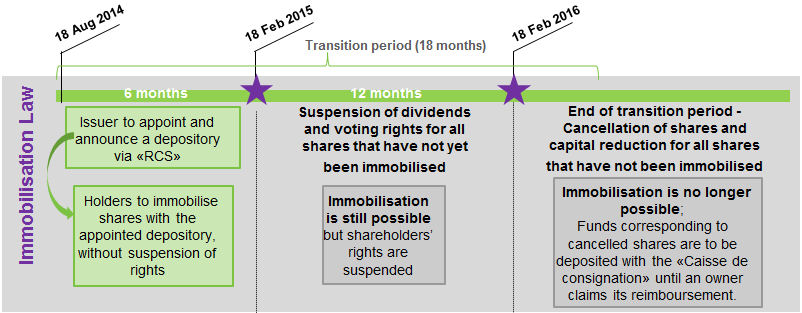

As from the entry into force of the Law, the issuers of existing shares/units have six months to appoint a depository (that is, publish the name of such depository in “Registre de commerce et des sociétés”) that meets the requirements of the Law.

4. Obligations for the shareholders

The holders of bearer shares/units have 18 months, as from the entry into force of the Law, to deposit the bearer shares/units with the depository appointed by the issuer.

5. Sanctions for non compliance

- If, six months after the entry into force of the Law, the aforementioned bearer shares/units are still not immobilised, voting rights related to them will be frozen and dividend payments will be deferred until the shares/units are effectively immobilised.

- If, 18 months after the entry into force of the Law, the aforementioned bearer shares/units are still not immobilised, they will be cancelled at the value obtained by dividing the net equity by the number of existing shares/units and the issuer will proceed with a corresponding reduction in the subscribed capital. Funds corresponding to the cancelled shares/units will be deposited with “Caisse de consignation” until an owner claims the reimbursement.

- In addition to the aforementioned sanctions, the directors or the members of the supervisory board of the issuer may be exposed to criminal and/or civil sanctions in cases of non-compliance to the Law.

Timeframe overview

Note: RCS=Régistre du Commerce et des Sociétés.

LuxCSD’s adaptations

LuxCSD2 does not hold bearer shares/units and strongly encourages dematerialisation as a mechanism to minimise the impacts of the immobilisation of bearer shares/units.

According to the Law, LuxCSD, being a credit institution and a Securities Settlement System (SSS) located in Luxembourg, has the capacity to be appointed as a depository by the issuer and is currently exploring a number of solutions to minimise impacts for its customers.

The implications of the new regulation (including the treatment of securities already immobilised with CSDs or SSSs, as well as the alignment of the Law with the immobilisation obligations imposed under the European CSD Regulation) are currently being discussed with the relevant stakeholders at market level, and LuxCSD is actively seeking to obtain full clarity on the scope and impacts of the Law.

Recommendation for customers

Given the very tight timeframe imposed by the Law and despite the lack of a clear understanding among market participants with regard to certain practical aspects, customers are encouraged to adopt a prudent approach and to take all necessary steps to ensure future compliance with the Law. To anticipate the first milestone defined by the Law and to avoid the suspension of shareholders’ rights as of 18 February 2015, we recommend that customers proactively inform their clients about the new legal requirements and the sanctions applicable in cases of non-compliance.

Further information

Official documentation is only available in French and can be found at http://www.chd.lu.

For further information, customers may contact LuxCSD Client Services or their Relationship Officer.

Important note:

As discussions are ongoing within the relevant authorities and market infrastructures, the content of this Announcement might be subject to change.

This Announcement is provided for general information purposes only. The information contained herein is not intended to provide professional legal advice and should not be relied upon in that regard. Customers should seek appropriate professional advice where necessary before taking any action based on the information contained in this document. LuxCSD makes no guarantees, representations or warranties and accepts no responsibility or liability as to the accuracy or completeness of the information and under no circumstances will it be liable for any loss or damage caused by reliance on any opinion, advice or statement made in this Announcement.

We continue to monitor the implementation of the Law and will provide more information when it becomes available.

------------------------------------------

1. Although the Law came into force in August,many aspects of the new legislation have been subject to different interpretations in the market. In these circumstances, we put on hold all communication to customers until further clarification would be available. However, given the very tight timeframe imposed by the Law and following the recommendation from legal experts, we finally decided to release the communication to customers for awareness purposes only. We expect to obtain further clarification of the Law from the Luxembourg authorities by early December 2014 at the latest.

2. LuxCSD refers to LuxCSD S.A., registered office at 42, avenue John F. Kennedy, L-1855 Luxembourg, and registered with the Luxembourg Trade and Companies Register under number B 154.449.