Standard Swift Release: Implementation of Enrolment Deadline for General Meetings Processing

Clearstream Banking1 informs clients that as of

24 November 2025

a new deadline dedicated to the Enrolment Date will be implemented in the General Meeting Notification message (seev.001).

Clearstream Banking will support the implementation of this deadline and will adjust their General Meeting processing flow to enhance the accuracy and efficiency of our services. Clearstream Banking has not been informed of any other market than Germany intending to use these new fields for processing purposes at this stage but also supports the fields when received from other markets and sources.

Clients are strongly encouraged to consider this notice to ensure they are aware of and comply with the full requirements provided below. Failure to comply may result in instructions being rejected due to a missed deadline.

Background

In some markets shareholders must enrole by a specific date prior to participating in a general meeting event. Currently, none of the deadlines available in the Meeting Notification message (seev.001) addresses this requirement. Thus, additional date fields - Enrolment Deadline and Enrolment Market Deadline - will be implemented.

With the implementation of Enrolment Deadline, clients may have to consider three deadlines for shares when instructing via Clearstream Banking, the Enrolment Deadline, the Securities Registration Deadline and the Vote Deadline and each has a respective issuer deadline (market deadline).

Enrolment Market Deadline is the date by which enrolment for participation in the general meeting event must be instructed to the issuer.

The Enrolment Market Deadline must precede or be equal to the Vote Market Deadline.

The Registration Market Deadline could be before or equal to the Enrolment Market Deadline.

German market

The Articles of Association may make participation in the Annual General Meeting or the exercise of voting rights contingent upon shareholders enrolment in advance of the meeting, see section § 123 (2) of the German Stock Corporation Act (AktG). Currently this process is common market practice in Germany.

The Enrolment Market Deadline is set by the issuer and is typically the close of business, seven business days before the meeting event but could also be closer to the meeting date when defined in the issuer’s Articles of Association.

The Vote Market Deadline is also set by the issuer and is then often close to or on the meeting date.

Several German issuers and their agents are planning to announce their meeting events to Clearstream Banking in its capacity as a central securities depository via ISO 20022 message formats.

As there was no field in ISO 20022 that could be used to distinguish between the Enrolment Market Deadline and the Vote Market Deadline, intermediaries and service providers commonly combined both market deadlines in their ISO 15022 and ISO 20022 meeting notifications. This resulted in the Vote Market Deadline for German events typically being seven business days before the meeting date, which never coincided with the issuer’s meeting notice. On the other hand, this enabled the relevant parties to submit the instruction by the enrolment deadline, thereby simplifying the operational process for investors and intermediaries.

When Clearstream Banking receives from their sources the Enrolment Market Deadline and the Vote Market Deadline, the Enrolment Deadline and the Vote Market Deadline will be set by Clearstream Banking based on the respective market deadlines and be decisive for the acceptance of instructions. Clients instructing via Clearstream Banking will have to meet Clearstream Banking’s Enrolment Deadline and could amend their voting behaviour until Clearstream Banking's Vote Deadline.

If no Enrolment Deadline is given in the Clearstream Banking meeting notification message, the Vote Deadline is the leading deadline to submit instructions to Clearstream Banking.

Meeting Notification (seev.001)

The new deadlines Enrolment Deadline and Enrolment Market Deadline will be available in the seev.001, MT564+ and via Xact Web Portal.

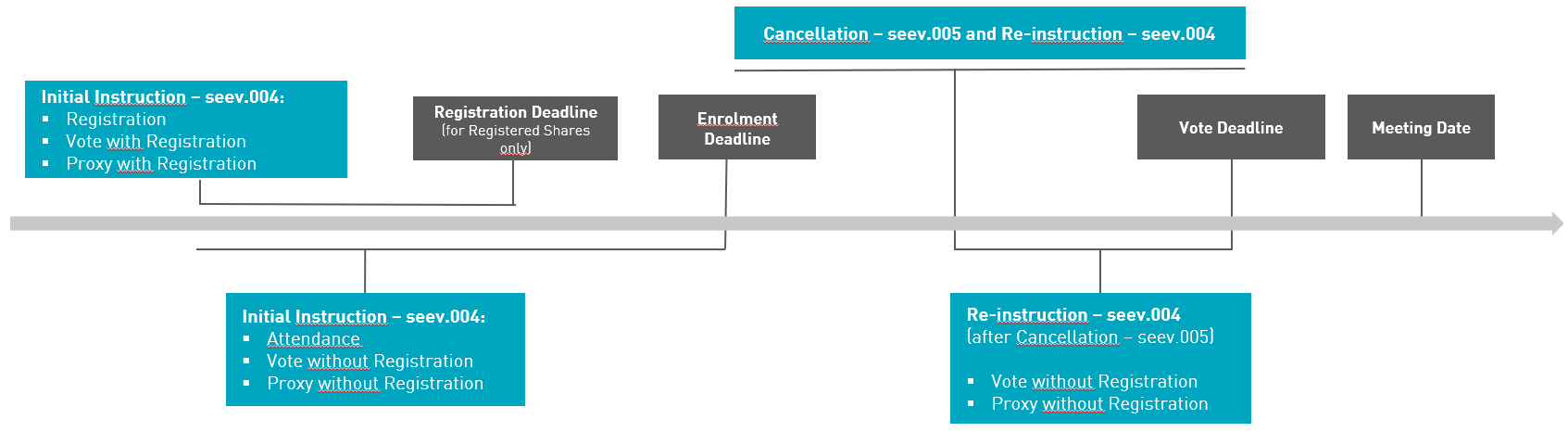

Meeting Instruction (seev.004/seev.005) processing

Instructing before the Enrolment Deadline – Initial Instruction

Clients must send their initial instructions by the Enrolment Deadline to show their intention to participate in the Meeting Event.

Re- instructing after the Enrolment Deadline, but before the Vote Deadline – Change of Voting behaviour after the Enrolment Deadline

To change the voting behaviour, the client must cancel the initial instruction sent before the Enrolment Deadline, and to re-instruct with a new instruction.

The following points are to be considered:

- Supported re-instruction types: The re-instruction should match the initial instruction in terms of the participation method and, when applicable, proxy type. Only Vote Without Registration or Proxy Without Registration instruction types using Proxy Type NEPR, CHRM, or none (with only vote section) will be processed. Any amendments requiring registration of securities or order of entrance cards are to be avoided.

- Instructed balance: Clients may not increase the instructed balance after the enrolment. The re-instructed balance must be smaller than or equal to the balance instructed initially. This also applies to the combined instructed balance when re-instructing with multiple single instructions. If the initial instruction has used all available amount (QALL), the re-instruction after Enrolment Date must specify the exact balance - usage of QALL is not allowed here.

- Registered shares: The Shareholder ID (Company Register Shareholder Identification) of the re-instruction must match the one of the initial instruction.

- References to the initial instruction and to the cancellation: The Instruction Cancellation message (seev.005) must include reference to the initial Single Instruction ID. Re-Instruction (seev.004) must include reference to the Instruction Cancellation message (Business Message ID of seev.005 in field Meeting Instruction Cancellation ID) and reference to the Single Instruction ID of the initial instruction.

Initial instruction (seev.004) | <BizMsgIdr>INX-555</BizMsgIdr> <SnglInstrId>AAABBB</SnglInstrId> | |

Instruction Cancellation (seev.005) | <BizMsgIdr>CANC123</BizMsgIdr> <SnglInstrId>AAABBB</SnglInstrId> | Reference the underlying instruction SID through the /MtgInstrCxlReq/ToBeCancInstr/SnglInstrId field |

Re-Instruction (seev.004) | <BizMsgIdr>INX-999</BizMsgIdr> <InstrCxlReqId> <MtgInstrCxlReqId>CANC123</MtgInstrCxlReqId> <SnglInstrId>AAABBB</SnglInstrId> </InstrCxlReqId > | Reference to the initial instruction Single Instruction ID through /MtgInstr/InstrCxlReqId/SnglInstrId Reference the cancellation message through /MtgInstr/InstrCxlReqId/MtgInstrCxlReqId |

Further information

For further information, please contact the Clearstream Banking Client Services or your Relationship Manager.

------------------------------------------

1. Clearstream Banking refers collectively to Clearstream Banking S.A., registered office at 42, avenue John F. Kennedy, L-1855 Luxembourg, and registered with the Luxembourg Trade and Companies Register under number B-9248, and Clearstream Banking AG, registered office at Mergenthalerallee 61, 65760 Eschborn, Germany and registered in Register B of the Amtsgericht Frankfurt am Main, Germany under number HRB 7500.