New German withholding tax regime for foreign investment funds - update II

Note: This announcement originally published on 15 December 2017 was updated to provide further clarification. Changes are highlighted.

Further to our Announcement A17137, dated 11 October 2017, regarding the implementation of the new German Investment Tax Act “Investmentsteuergesetz; InvStG”, Clearstream Banking1 informs customers in detail about the impact on tax instructions, requirements for tax reclaim processing and the German tax voucher application process and how customers can request German tax vouchers via Clearstream Banking.

The new German Investment Tax Act will enter into effect on

1 January 2018

and will significantly change the taxation of dividends and similar income from investments in German equities, participation rights and convertible bonds held by foreign investment funds.

Current situation

German income payments paid to a foreign investment fund are subject to 26.375% withholding tax (Kapitalertragsertragsteuer; KESt) and Solidarity Surcharge (Solidaritätszuschlag; SolZ)). For all Clearstream Banking accounts 25% KESt and 5.5% SolZ of the KESt amount are deducted for German dividends, income of participation rights and taxable convertible bonds and for cash distributions and distributions of tax liquidity of German funds. The KESt amount is calculated based on the taxation base (parts of taxation base for event type cash distributions and distributions of tax liquidity).

Dividends paid to a foreign investment fund pursuant to § 1 “InvStG”

Under the new act, if the foreign investment fund obtains and provides a Fund Status Certificate for classification of the fund pursuant to § 1 InvStG, the German KESt will be reduced to 15% at source irrespective of the location of the fund. If the Fund Status Certificate is submitted after the payment date of the event the overpaid KESt amount (11.375%) can be reclaimed within a period of 18 months. The Fund Status Certificate must be requested from the German Tax Authorities.

Future principles applied in Clearstream Banking

From 1 January 2018 no KESt and SolZ are deducted by Clearstream Banking for fund distributions of German funds if evidence is provided that the fund is an investment fund pursuant to § 1 InvStG or a special investment fund pursuant to § 53 InvStG. For funds not certified accordingly the current tax deduction logic is applied; if no taxation base parts are delivered and the income amount is taken as the taxation base.

Distributions of tax liquidity will no longer be processed. Exemptions that still can take place in 2018 are distributions of tax liquidity that are due to corrections or income with fiscal payment date prior to 1 January 2018.

Dividends and similar income in German equities, participation rights and convertible bonds, held by a fund for their clients can be processed by Clearstream Banking at the reduced tax rate:

- 14.218% KESt standard rate, if evidence is provided (status certificate) for classification of the fund as a fund pursuant to § 1 InvStG or a special investment fund pursuant to § 53 InvStG; or

0% (for tax-privileged German or comparable foreign investors, for example, churches, non-profit organisations, foundations, corporations under public law).

Under the new act, if the foreign investment fund obtains and provides a “Fund Status Certificate” including special investment funds not opting for transparency pursuant to § 26 InvStG the German KESt will be reduced to 15% (KESt standard rate of 14.218% plus a SolZ of 5.5% of the standard rate) at source. Foreign investment funds with tax-privileged German or comparable foreign investors or special investment funds opting for transparency pursuant may even be able to obtain full reclaim for this specific investor type or individual tax rates on end-investor level of German KESt if certain formal requirements are met. One of the requirements will be proof of the minimum holding period of 45 days over the dividend entitlement date pursuant to § 36a German Income Tax Act (Einkommenssteuergesetz; EStG).

Note: Until further notice, Clearstream Banking will not be in the position to offer services for full reclaim of German KESt or consideration of individual tax status of end investors (for special investment funds opting for transparency pursuant to § 30 of the InvStG).

This has the consequence that Clearstream Banking cannot consider the Funds Status Certificate by special investment funds opting for transparency pursuant to § 30 InvStG and no tax reduction can be granted. Payments must be executed by Clearstream Banking with the full tax rate of 26.375%.

End investors must reclaim the tax exemption individually from the local tax authority (Betriebsstätten-Finanzamt) of CBF:

Finanzamt Wiesbaden I

Dostojewskistraße 8

D-65187 Wiesbaden

(CBF Tax-ID / Steuernummer: 040 220 13205)

Reclaims based on a Double Taxation Treaty (pursuant to §50d EStG) will be untouched and the forms must be forwarded via Clearstream Banking or directly to the Federal Central Tax Office (Bundeszentralamt für Steuern;BZSt): Bundeszentralamt für Steuern, D-53221 Bonn.

Processing of tax reduction for funds

The tax reduction is processed based on a breakdown of the entitled holding on a customer account. The tax reduction can be processed at payment date of the event (tax relief) or up to 18 months afterwards (tax refund). A request is submitted for an account, fund, reduced tax rate and event. It is foreseen to set up a request for tax reduction via the BO Upload application.

Customers must provide the following information in a CSV file when requesting a tax reduction (tax breakdown):

- Clearstream Banking AG (CBF) account number 7201 (mandatory for Clearstream Banking S.A. (CBL) customers);

- ISIN of fund/ Ordnungsnummer mentioned in the Tax Status Certificate;

- Nominal per fund;

- Reduced KESt rate (14.218% ());

- ISIN of the income event;

- For requests submitted before entitlement/record date:

- BID (filled by CBF);

- Payment date for the coupon payment.

- For requests submitted after entitlement/record date:

- Event type (filled by CBF);

- KADI-LAUF-NR (filled by CBF).

Note: In the future, Clearstream Banking will change the identification and validation of investment funds in possession of a Fund Status Certificate. To request a German tax voucher customers must provide together with the tax reduction instruction or transmission of end investor data the Ordnungsnummer from the Funds Status Certificate instead the ISIN of the fund (mentioned in line 8 and potentially in line 35 and 37 of the application to request the Funds Status Certificate from the BZSt).

Customers can upload data required for tax reduction in a CSV file via the BO Upload application. Updated CSV file format rules are attached below. BO Upload includes a validation of the fund ISINs/ Ordnungsnummer against reference data indicating the eligibility for tax rate reduction (14.218%).

Without the information of the ISIN - in the future Ordnungsnummer - of the fund no tax reduction can be processed by Clearstream Banking.

Uploads can be sent to Clearstream Banking at the earliest 14 business days before the ex-date of the upcoming event and up to 18 months after the ex-date.

Uploads will be processed immediately depending on the quality of the tax breakdowns transmitted to Clearstream Banking.

Note: Clearstream Banking cannot guarantee to process tax breakdowns for tax relief on value day of the income event. The submission deadlines of uploads for tax relief will be provided at the beginning of 2018.

Important note: Customers must provide at the latest with the first upload of tax breakdown an original Fund Status Certificate for each Fund Company requesting a tax reduction. For each Fund Status Certificate customers must inform Clearstream Banking in the cover letter to which accounts the Fund Status Certificate should be linked and must state the ISIN of the fund (mentioned in line 8 and potentially inline 35 and 37 of the application to request the Funds Status Certificate from the BZSt).

The Fund Status Certificate must be sent to:

Clearstream Banking AG

attn. Tax Services Frankfurt

Mergenthaleralle 61

D-65760 Eschborn.

Pricing

Applicable fees will be announced in due course in the Clearstream Banking Fee Schedule.

Bookings for tax reduction

Clearstream Banking will book the tax relief as “refund”. This means that customers will first receive the income payment with the full tax rate of 26.375%. After processing the tax breakdown (CSV file upload via the BO Upload application) a tax reclaim payment will be booked in the same way as today for double taxation treaty (DTT) tax reclaims.

Tax vouchers

Upon request, tax vouchers are provided for funds, whereby a validation is processed against the nominal of tax reductions. For special investment funds opting for transparency the information required by § 31 (1) InvStG (nominal and KESt rate of end investors) must be provided with the request. Tax vouchers requested by special investment funds opting for transparency must remain with the special investment fund. The special investment fund must then transmit to each investor a copy of the tax voucher. The deletion of the names of other investors is inadmissibly.

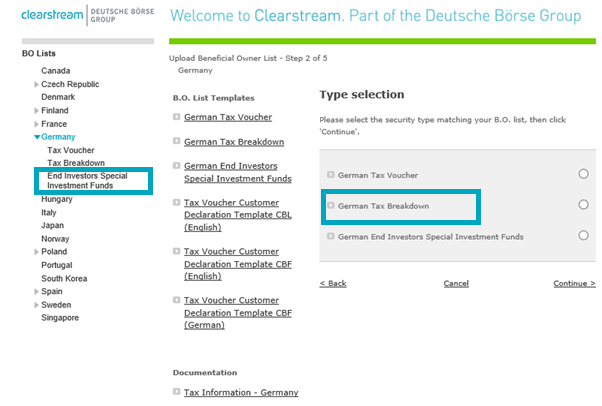

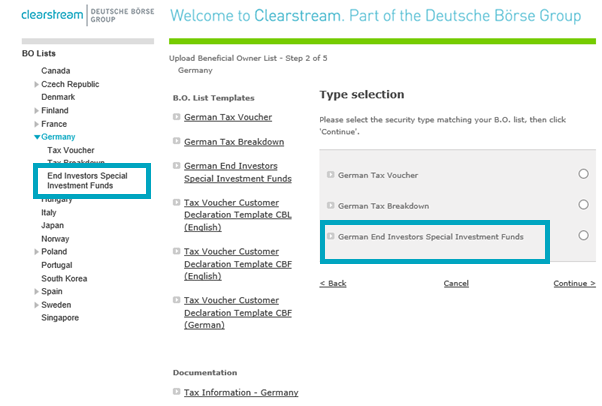

Customers must upload end-investor data in a CSV file via the BO Upload, BO list, Market Germany. Updated CSV file format rules are attached below.

Clearstream Banking assumes that there will be no change to the official template for Tax Voucher for payments before 1 January 2018. The requirements for issuance of a Tax Voucher to a CBL customer for their own holdings or holdings of their clients remain unchanged (please refer to Announcement A16051, dated 29 March 2016).

Note: If the information of the transparency option was not transported in the multi-level depository chain to the German tax agent, the Fund Status Certificate was considered and Clearstream Banking and its depository CBF are aware of the transparency option with the request for issuing a German tax voucher. Clearstream Banking must cancel the tax reclaim payment and issue the tax voucher following the new requirements.

As mentioned above Clearstream Banking will not be in the position to offer services for full reclaim of German KESt or consideration of an individual tax status of end investors for special investment funds opting for transparency pursuant to § 30 InvStG. This has the consequence that Clearstream Banking cannot consider the Funds Status Certificate provided by special investment funds opting for transparency and no tax reduction can be granted. Payments must be executed by Clearstream Banking with the full tax rate of 26.375%.

Note: The German Ministry of Finance is due to provide clarification on open questions in writing to the market. The Ministry of Finance published on 15 December 2017 with Circular „Kapitalertragsteuer; Ausstellung von Steuerbescheinigungen für Kapitalerträge nach § 45a Absatz 2 und 3 EStG; Neuveröffentlichung des BMF-Schreibens“ with reference GZ IV C 1 - S 2401/08/10001 :018 DOK 2017/1044120 details for new tax voucher templates. Currently, Clearstream Banking is not in the position to issue Tax Vouchers (new template III) for payments after 31 December 2017. Clearstream Banking will inform customers when a new tax voucher (template III) is available.

Standing instructions

Cleastream Banking is analysing with its depository CBF if standing instruction in form of a segregated account can be offered to customers. CBF is in discussion with legal advisor and tax authorities to clarify when customer declare that segregated account will be used only for certified fund companies and all original Fund Status Certificates are provided to Clearstream Banking before first settlement in such an account if this practice is accepted by the local tax authority.

For segregated accounts all income payments subject to German withholding tax will be paid automatically with the reduced tax rate of 15% (KESt standard rate of 14.218% plus a SolZ of 5.5% of the standard rate) to customers. Market Claims will be calculated and executed automatically with the reduced tax rate too. CBF is under discussion with the tax authorities if customers must provide a break down to disclose the name of the fund company (via the Ordnungsnummer) per single income payment and the relevant holdings of that the fund company after the end of market claim period, with the request to issue a German tax voucher or at the end of the year of payment.

Processing of tax reclaims resulting from DTT at the German Federal Central Office

The requirements for processing tax reclaims resulting from DTT of the German Federal Central Office remain unchanged (please refer to Announcement A16051, dated 29 March 2016).