T2S and CEU Releases – Information on the production launches in November 2025 - Update

Note: This Announcement, originally published on 30 May 2025, has been updated to deliver more details for the CRs T2S-0812-URD, T2S-0827-SYS and the CEU Release. Changes have been highlighted.

Clearstream Europe AG1 informs clients about the TARGET2-Securities (T2S) R2025.NOV and the CEU release in November 2025.

According to the T2S Release Concept, the releases will be deployed on

the weekend 22 and 23 November 2025

for business day, Monday, 24 November 2025

T2S R2025.NOV – Scope

With the T2S Release R2025.NOV, six Change Requests (CRs) will be introduced in production. They have already been approved at T2S Steering Level. In addition, the release will fix various malfunctions and close the related T2S Problem Tickets (PBIs). In the event of urgency and if priority is given, further functional updates might be authorised by the Operational Managers Group (OMG). If such changes are announced by T2S, CEU will inform clients in due time.

The following overview presents the scope elements for T2S Release R2025.NOV and indicates if the modification might have impact on CEU clients acting in Indirect Participant (ICP) and / or Direct Participant (DCP) mode:

T2S Change Requests

At present, six CRs are scheduled for implementation by T2S. Please find all approved T2S Change Requests (CRs) in the list attached.

Based on the functional description provided by T2S, CEU identified the system requirements for T2S R2025.NOV. CEU aims to absorb the impact on clients acting in ICP mode as much as possible.

In the attached list, clients acting in (Cash) DCP mode will find additional information. More details on these requirements can be found in the related ECB documentation2. Regarding CR T2S-0820-SYS, Announcement D25015 has been published.

Problem Tickets (PBIs)

CEU review of the latest list of pending PBIs, provided by T2S (as of mid of September 2025), shows that currently five T2S Problem Tickets (PBIs) might impact CEU clients operating in cash ICP and/or (cash) DCP mode. Two further PBIs affecting DCPs are still waiting for the final decision to be implemented with the T2S R2025.NOV release (candidates). CEU recommends clients to check the PBI list attached.

Experience from CEU’s periodic assessment of these lists shows that until the launch of a T2S release, additional tickets will be authorised for implementation. Therefore, this Announcement will be updated with newly prioritised PBIs once more.

Transition plan

The installation of T2S Release R2025.NOV into production is planned for the third weekend in November 2025. The deployment will be executed via the “Release Weekend Schedule”. As with the introduction of the previous T2S Releases, the schedule of the T2S Operational Day will be modified according to the implementation activities. The deployment will start once the end of day procedure (“T2S End of Day”) on Friday, 21 November 2025, has been completed. In the week before the implementation, CEU aims to provide an indicative timeline for changes in the operational day during the deployment weekend.

The table below provides an overview of the important T2S milestones within the next months:

T2S Service Transition Plan

Activity for T2S Release R2025.NOV | Date |

End of testing of R2025.NOV scope elements in Pre-Production | Wednesday, 5 November 2025 |

MIB approves the R2025.NOV deployment to Production | Tuesday, 11 November 2025 |

Deployment of R2025.NOV to Production | Saturday, 22 November 2025 |

T2S CRs with potential client impact

The following CRs complement the current scope of services and will be available to CEU clients after the implementation of T2S Release R2025.NOV. These changes do not require any software modifications in CEU's client-facing systems. However, CEU recommends clients to review the changes for any necessary adjustments in their operational procedures.

T2S-0812-SYS “'Party hold’ as a new category of restriction type case one rules”

When a T2S Party grants a Power of Attorney (PoA) to a third party to instruct on their behalf, the latter gets access to the securities and the dedicated cash account (SAC and DCA) of the T2S Party.

This is often the case when Central Counterparties (CCPs) or Trading Venues instruct already-matched instructions on their clients’ accounts. Other service providers’ to-be-matched instructions can have the same effect.

To guarantee the T2S Parties control over their own security and cash positions, these transactions should possibly be instructed “on hold” (with qualifier PREA). Once the T2S Party has secured the necessary stock and liquidity, the T2S Party can release the instruction at its own discretion.

This CR offers the possibility to transform the currently optional choice of instructing “on hold” to a mandatory process in T2S. Therefore, with the T2S R2025.NOV release, T2S will introduce a new optional restriction type called “Party Hold” that mandatorily sets settlement transactions received from selected third parties (PoA takers, CCP for instance) on their client’s account (SAC3 of the PoA-givers, CCP client for instance) on Party Hold.

The new restriction type Party Hold is set up by the central depositories (CSDs).

Based on an agreement with the third party, CEU clients can opt for the restriction “Party Hold” on their accounts. In this case, it is necessary to submit the attached form 03 completed and signed by both the third party (service providers such as CCPs) and the CEU client. CCPs and trading venues interested in the new T2S service are invited to contact CEU for more details.

T2S-0827-URD “T2S should submit partially released instruction to settlement independent from T2S partial settlement windows.”

Currently, the T2S partial settlement takes place in so-called windows, which open every two hours during the real-time settlement period (RTS, at 8:00, 10:00, 12:00, 14:00 and prior to the delivery versus payment (DVP) cutoff). This can lead to delays of up to two hours before a partially released instruction is settled, limiting the timely reuse of securities.

With the implementation of CR T2S-0827-SYS, T2S will enhance settlement efficiency by introducing during the real-time settlement period an immediate settlement attempt of the entire partially released quantity immediately after the partial release has been executed, regardless of partial settlement windows.

If this immediate settlement attempt fails due to insufficient securities on the delivering account or lack of cash on the receiving account, T2S will not retry settlement until the next scheduled partial settlement window.

During a partial settlement window, the current settlement logic for partially released instructions will remain unchanged.

CEU Release

Following the successful harmonisation of processes, services and reporting for Asset Servicing, Clearstream aims to achieve a similar level of harmonisation in the Settlement Services.

The target is to align the service offering with T2S and Swift standards as well as a harmonisation between CEU and Clearstream Banking S.A. (CBL).

In a first step, the client ClearstreamXact Reporting will be enhanced during the course of 2025 and 2026, starting in the November 2025 Release with the following improvements:

Report subscription on T2S Party Level

In addition to the existing option to subscribe to the ClearstreamXact Settlement Reporting on a seven-digit sub-account level, CEU clients will be able to subscribe to the reporting for all T2S security accounts (T2S SAC) based on the 4-digit account master level which includes all related seven-digit sub-accounts. As each 4-digit account master corresponds uniquely to a T2S PARTY BIC, both can be used as CEU party identification.

It will be possible that a specific account can be in parallel part of a subscription on account master (four-digit)/T2S party BIC level and in a subscription on account level (seven-digit). In this case, the CEU client will receive one report with data for each (seven-digits) account related to an account master and another report with data for the (seven-digit) account he subscribed specifically for.

ClearstreamXact will offer the new subscription option for the following ISO 15022 Message Types (MT):

Message types | Subscription level | Report level |

MT544 - MT547, MT548, MT578 | Account, account master or Party BIC | Per instruction |

MT535, MT536, MT537, MT538 | Account, account master or Party BIC | Per account |

MT537 PENA, MT586 | Account master or Party BIC | Per account master or Party BIC |

For subscriptions on party level,

- it will not be possible to de-select one of the accounts; and

- Xact Web Portal will reject the subscription when the user does not have the privilege for all linked accounts.

Subscription Filter for Allegements

Currently, CEU clients need the following two subscriptions in Xact Web Portal to receive an MT578 (Settlement Allegement Report) and MT586 (Statement of Settlement Allegements Report) reporting of all possible allegements:

- Allegements against own account (default);

- Allegements against BIC linked to the own account (optional).

From the release in November 2025, CEU clients will receive all allegement messages via one single subscription. Hence, the option to “Show Allegements against BIC” will no longer be offered in Xact Web Portal.

Cutover procedure

Existing subscriptions for MT578 and MT586 reports will be migrated by Clearstream to the new comprehensive option. Impacted clients will be contacted.

Identification of reversals

With the Release in November 2025, CEU clients will be able to identify T2S reversals in their ClearstreamXact reporting. These bookings will be reported in ClearstreamXact in Field 22F (Settlement Transaction Indicator) with Data Source Scheme DAKV and the transaction indicator REVL:

:22F::SETR/DAKV/REVL

This change will be implemented for the following message types (MT): MT536, MT544-MT547 and MT548.

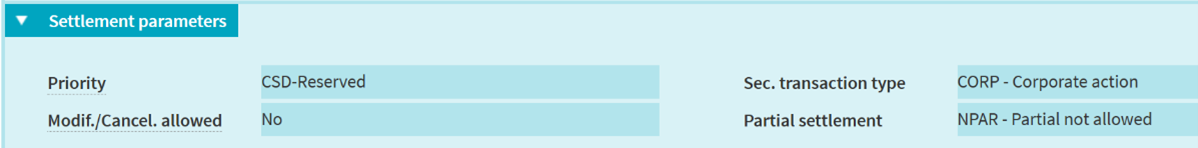

Usage of Settlement Indicator CORP for Asset Servicing related settlement reporting messages

Currently, the ClearstreamXact reporting provides the Settlement Indicator TRAD in the Settlement Transaction Indicator field 22F even for instructions related to a corporate event:

:22F::SETR//TRAD.

With the release in November 2025, ClearstreamXact reporting will provide the correct Settlement Transaction Indicator CORP for Asset Servicing related messages in the field:

:22F::SETR/COEX/CORP

The following message types will be affected: MT536, MT537, MT544-547, MT548, MT578 and MT586.

In Xact Web Portal, the qualifier CORP is already shown in the field Sec. transaction type:

Reporting of Beneficial Owner details in Settlement Party Fields for CASCADE instruction types AA03 and AA18

In CEU Legacy reporting, information related to the beneficial owner in instruction types AA03 (“Finanzagentur” transfer) and AA18 (physical deliveries: withdrawal/mark down) is provided via certain LIMA labels.

These details will now also be reported in MT544-547 and MT548 messages via ClearstreamXact by mapping the CASCADE fields to the Settlement Party fields of these messages:

CASCADE field name (KVEE) | LIMA label | ClearstreamXact (MT544-7 and MT548) |

LKZ | /CDCO | 95Q SELL or 95Q BUYR |

PLZ | /CDPO | 95Q SELL or 95Q BUYR |

NAME1 | /NAME | 95Q SELL or 95Q BUYR |

VORNAME1 | /FNAM | 95Q SELL or 95Q BUYR |

STRASSE | /STPO | 95Q SELL or 95Q BUYR |

ORT | /CITY | 95Q SELL or 95Q BUYR |

NAME2 | /NAM2 | 95Q SELL or 95Q BUYR |

VORNAME2 | /FNA2 | 95Q SELL or 95Q BUYR |

MT535: Modification of Statement of Holdings report

To reflect specific sub-balances in the MT535 (Statement of Holdings) report, ClearstreamXact will introduce the respective codes that are already part of the existing Legacy reporting:

- without Data Source Scheme (DSS) when the sub-balance code is part of the ISO 15022 code list;

- with DSS COEX when the sub-balance code is not part of the ISO 15022 code list; and

- with DSS DAKV when the sub-balance code is a market specific code set up in T2S by CEU.

T2S sub balance code | Reported in Clearstream Xact | Description |

AWAS | //AWAS | Deliverable Position |

BLCA | //BLCA | Blocked for Corporate Action |

BLOK | //BLOK | Blocked Sub-balance |

COLL | /COEX/COLL | Collateralised |

COSP | /COEX/COSP | Position blocked for Conditional Securities Delivery (reflected in legacy reporting on sub-account XXXX 995) |

DRAW | //DRAW | Blocked for Redemption (Drawn) |

EDKK | /COEX/EDKK | Position reserved for auto-collateralisation (DKK) |

EEUR | /COEX/EEUR | Position reserved for auto-collateralisation (EUR) |

EXXX | /COEX/EXXX | Position reserved for auto-collateralisation |

RSHB | /DAKV/RSHB | Position represents CASCADE RS 'HB' and 'ZMB' |

RSKE | /DAKV/RSKE | Position represents CASCADE RS 'KE' positions in T2S |

RSTR | //RSTR | Blocked for Certification (Restricted Sub-balance; reflected in legacy reporting on sub-account XXXX 851) |

Additionally, the total balance of securities that are available/not available for settlement by CEU clients (in :93:B:AVAI, respectively NAVL) will be adapted:

- The available balance (:93:B::AVAI) will be the sum of sub-balances AWAS +EDKK+EXXX +EEUR;

- The balance which is not available for settlement (:93:B::NAVL) will be the sum of sub-balances; BLCA+BLOK+COLL+COSP+DRAW+RSHB+RSKE+RSTR; and

- The overall sum will continue to be reported in :93:B::AGGR (AVAI + NAVL).

Introduction of MT538 Position Type Reporting for CEU clients

With the release in November 2025, new MT538 messages (Statement of Intra-Position Advice) via ClearstreamXact Reporting will be introduced for T2S instructions to enable CEU clients to follow up on the different blocking status reasons for a specific position within their securities balances.

In the new MT538 messages, the type of blocking will be reported in the fields :93A::FROM (from balance) and :93A::TOBA (to balance) using to the same T2S sub-balance codes (and their reflection in ClearstreamXact) as described above for the MT535 reporting.

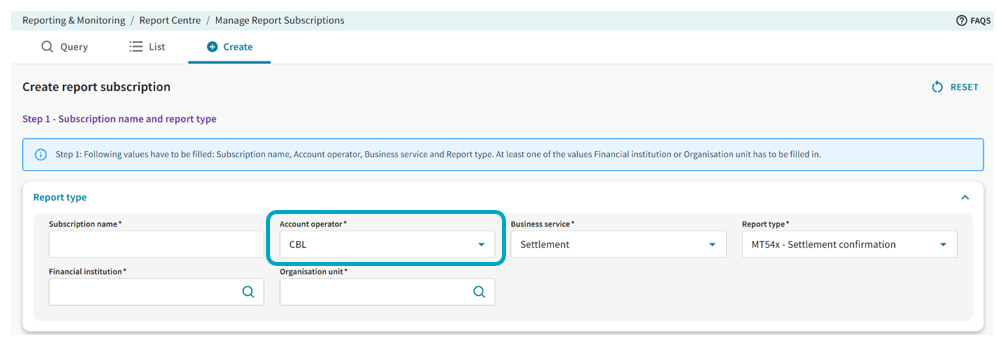

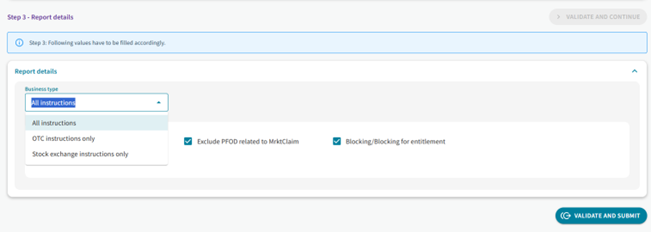

Subscription filter for stock exchange instructions in Xact Web Portal

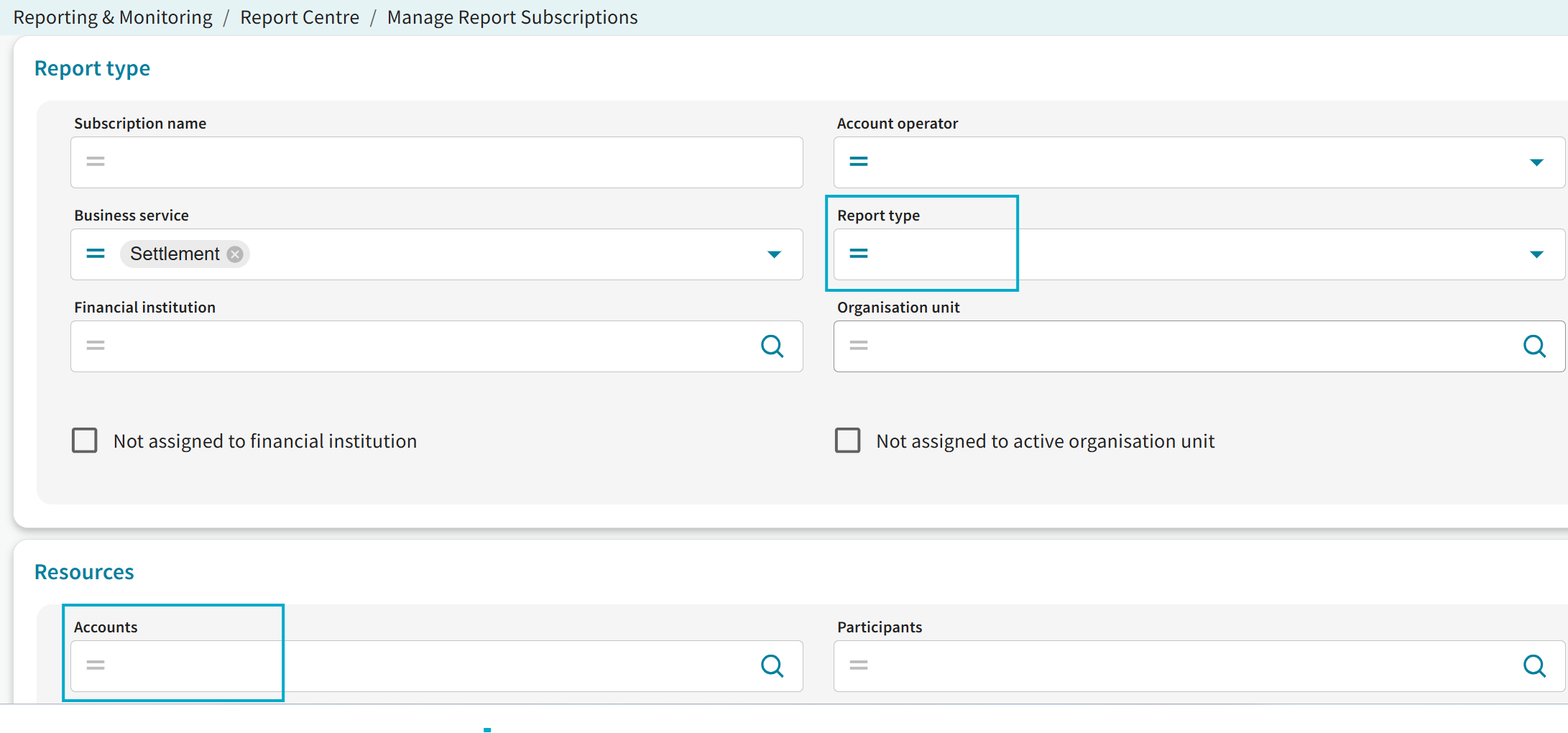

Currently, CEU clients can subscribe for a ClearstreamXact reporting for their five-digit 6-series accounts in the following menu by selecting the “Account Operator CBL”:

When choosing the report details, the report subscription offers under the option "Business type" (third process step) the following selections:

- All instructions

- OTC instructions only

- Stock exchange instructions only

With the release in November 2025, this subscription filter will also be available under the “Account Operator CBF-T2S” for seven-digit accounts.

The subscription filter will be available for the reporting of message types MT537, MT548 and MT544-547.

Client simulation

The simulation activities for the T2S release will be conducted in a “free simulation mode”. The already established static data for CEU accounts and the related connectivity settings in the CEU client simulation environment (IMS23) remain unchanged. If clients need any adjustments of the setup in the client simulation environment or additional information on the simulation requirements, they can contact connect-test@clearstream.com.

According to the ECB planning, the updated software for the T2S Release R2025.NOV has been installed on Friday, 26 September 2025, in the T2S Pre-Production Environment (UTEST). From Monday, 29 September 2025, DCPs can start their simulation activities. In IMS23, the new software will be available on 20 October 2025. Details about extraordinary closing days and opening hours (UTEST/IMS23/OCCT) are available under Availability and schedules of the client simulation.

Contact

For further information, clients may contact Clearstream Client Services or their Relationship Officer. Questions related to the technical connection can be addressed to Connectivity Support. Particular questions related to the production launch in November 2025 will be routed to the experts of the T2S Release Management.

------------------------------------------

1. This Announcement is published by Clearstream Europe AG (CEU), registered office at Mergenthalerallee 61, 65760 Eschborn, Germany, registered with the Commercial Register of the District Court in Frankfurt am Main, Germany, under number HRB 7500.

2. Details about the scope elements of T2S Release R2025.NOV are published on the ECB’s website. Currently, the list available reflects the status of July 2025.

3. T2S Security Account.