Clearstream Default Management

1. Clearstream Default Management Process

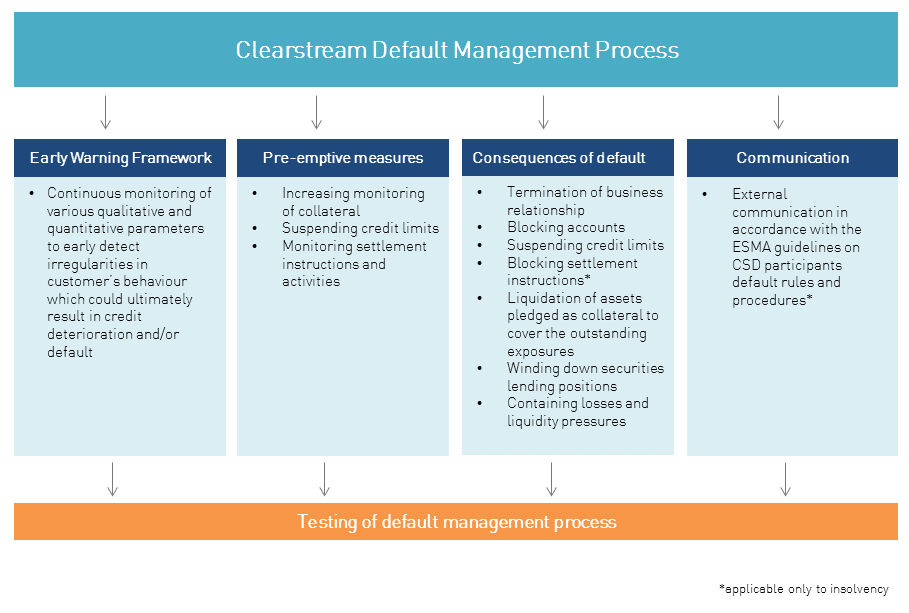

The default management process of Clearstream Banking S.A. and Clearstream Europe AG (hereafter “Clearstream”) has been implemented to mitigate the risks arising from the default of a Clearstream client and enables Clearstream to avoid and minimise losses related to a client default. The non-defaulting clients of Clearstream also benefit from the default management process as its purpose is to manage a client default in a prudent and orderly manner, limiting disruptions to the market and avoiding changes to the normal settlement practices of non-defaulting Clearstream clients.

Important note: The process described hereafter is the general approach to handle a default in accordance with the Principle 13 of CPSS-IOSCO and article 41 (1) of the Regulation (EU) No 909/2014 on improving securities settlement in the European Union and on central securities depositories (hereinafter “CSDR”). It does not override the contractual agreements (GTCs and/or bilateral agreement(s)) in place with the client.

2. Overview of Clearstream Default Management Process

The default management process of Clearstream has been implemented in accordance with the Principle 13 CPSS-IOSCO and CSD-Regulation and can be summarised as follows:

According to the Article 41 (2) of CSDR, the Clearstream Default Management presented here is part of the relevant default rules and procedures that should be made available to the public.

2.1 Early Warning Framework

The Early Warning Framework is an important component of the Clearstream default management process. It includes the continuous monitoring of defined indicators and their thresholds across various business areas of Clearstream in order to ensure an early detection of irregularities in client’s behaviour, which could ultimately result in client’s credit deterioration or default.

2.2 Pre-emptive measures

In order to mitigate the risks resulting from arising client default, Clearstream has a set of pre-emptive measures that can be implemented. These include increasing monitoring of collateral, suspending credit limits, monitoring settlement instructions, account blocking etc.

2.2.1 Increasing monitoring of collateral

Clearstream has the right to tighten the acceptance criteria for collateral eligibility or increase haircuts in order to prevent decreasing collateral value due to changing market conditions.

2.2.2 Suspending credit limits

Clearstream may suspend or terminate the credit limits (cash or securities financing arrangements) in case of deterioration in the client’s financial situation or the value of the provided collateral, which secures the credit limits.

2.2.3 Monitoring settlement instructions

Clearstream will implement a regular monitoring of client's activities/settlement instructions. At the same time, the level of communication with the affected client would increase as well as the monitoring of all sources of information (e.g. press, rating agencies, etc.)

2.3 Default

2.3.1 Types of default

Clearstream defines two types of default:

- General default: A client is unable to fulfil its contractual obligation according to an agreement with Clearstream where insolvency proceedings, as defined in point (j) of Article 2 of Directive 98/26/EC on settlement finality in payment and securities settlement systems, as amended (“Settlement Finality Directive”), are opened against a client (”insolvency proceedings” shall mean any collective measure provided for in the law of a Member State, or a third country, either to wind up the participant or to reorganise it, where such measure involves the suspending of, or imposing limitations on, transfers or payments);

- Contractual default: A client is unable to fulfil, in a timely manner, one or more of its scheduled contractual obligations according to an agreement with Clearstream.

2.3.2 Acknowledgement of client default

The default rules and procedures are implemented once a client default (insolvency/bankruptcy, liquidation, reorganisation, or any other proceeding seeking similar relief with respect to the client or their debts) is identified and all reasonable actions are taken to verify its occurrence. The communication of default to Clearstream may be done by the client itself, a competent authority, or any other entity with knowledge of the existence of the default. To this end, Clearstream clients are requested to notify Clearstream of their default in accordance with the CBL GTCs and CEU GTCs in writing or electronically to default.inbox@clearstream.com as soon as possible. Following that, Clearstream will transmit this information along with its source to its competent authorities.

2.4 Consequences of default

2.4.1 Terminating business relationship and services

A default could trigger a termination of business relationship and services. Clearstream may terminate the complete business relationship, individual business connections or the performance of particular services. A reason for termination is, inter alia, if a client no longer meets one or more Clearstream's criteria for participation, and/or the participation of a client materially impairs the Clearstream system, the interest of Clearstream or any other clients, including in particular, the financial position of the client is threatened or client is in breach of any obligation incumbent upon him under the governing documents or any other agreement with Clearstream. The Executive Board will decide on case-by-case basis whether the business relationship should be terminated.

2.4.2 Blocking accounts

In case of a client default, Clearstream may have the right to block client’s accounts subject to certain conditions pursuant to the GTCs. The decision to block an account is made by the Executive Board or upon instruction from an authority/regulator.

2.4.3 Suspending credit limits

If not already implemented as a pre-emptive measure, a default of a client may lead to suspension/termination of credit limits as described under 2.2.2.

2.4.4 Blocking settlement instructions

In order to ensure protection of settlement for non-defaulting clients, the transactions of defaulting clients may be suspended from automatic transaction processing, to the extent permitted by law and according to the contractual agreements in place between Clearstream and the client. All transactions will then be manually monitored. In the specific case of client insolvency, the handling of pending settlement instructions is undertaken according to the rules of the Settlement Finality Directive as presented in the attachment below.

2.4.5 Liquidation

Once a client default occurs, liquidation of client’s assets pledged as collateral is undertaken with the objective of closing the outstanding exposures, either from usage of credit limits or due to uncovered fees as quickly as possible and with the lowest market impact possible.

2.4.5.1 Use of cash

Before liquidating securities, positive cash balances held on other client accounts and positive cash balances in other currencies are considered to offset the exposure.

2.4.5.2 Collateral selection

Securities foreseen for liquidation are selected from the dedicated collateral pool in order to cover the outstanding exposures. Clearstream can select collateral from the account(s) pledged under the contractual arrangement(s) and/or according to the GTCs.

2.4.6 Securities lending positions

In securities lending CBL acts as an intermediary between the client lending and the client borrowing the securities. In case a client that borrows the securities defaults, CBL will apply the following alternatives:

- Reimbursement of the loan securities to the lending client;

- Transfer of cash received from collateral liquidation to the lending client;

- Transfer of collateral to the lending client up to the valuation amount of the corresponding loan securities.

2.4.7 Containing losses and liquidity pressures

To cover the outstanding exposures, which could potentially result in losses, Clearstream will liquidate the defaulting client’s assets pledged as collateral as described above. A timely liquidation and robust haircuts on collateral (described in the CBL Client Handbook in the section “Collateral valuation”) should ensure that Clearstream contains potential losses.

For Clearstream, the target for the liquidity management is the ability to respond to daily, including intraday, changing client net long/short cash balances. Funds are invested within strict mismatch limits in place to limit liquidity risk with the objective to have:

- sufficient liquid resources such as highly liquid own assets and collateral readily available and convertible into cash to sustain liquidity risks under a wide range of potential stress scenarios, including intraday, and

- a maximum of liquidity available intraday and within one business day via overnight secured/unsecured placements and overnight foreign exchange swaps with creditworthy financial institutions mostly executed after the client deadline towards the respective currency.

In addition to its liquidity management target, Clearstream has a large panel of liquidity measures, including intraday, in place to face and remedy a situation involving liquidity pressure in period of stress. These are among others:

- Highly reliable prearranged funding arrangements of committed and uncommitted nature (repo markets);

- Access to CCP-cleared repo markets;

- Central bank arrangements (ECB open market operations and ECB marginal lending facility);

- FX swap facilities of committed and uncommitted nature;

- Money market funding counterparties;

- Multi-currency ECP (Euro Commercial Paper) programme;

- Revolving Credit Facility (with intraday drawing capability).

All instruments are tested on a regular basis with the aim to ensure that operational procedures are in place and sufficient.

3. Communication

In accordance with the ESMA guidelines on CSD participants default rules and procedures, Clearstream will notify as soon as possible its competent authorities and the defaulting client of the actions to be taken or taken following a default (related to the insolvency or similar proceeding of a client), and will also inform, as soon as possible:

- its relevant authorities;

- ESMA;

- its non-defaulting participants;

- the trading venues and CCPs served by the CSD;

- the operator of the common settlement infrastructure used by the CSD;

- the linked CSDs.

Clearstream will also increase the communication with the impacted client in order to ensure the highest level of transparency as possible.

4. Governance

The default management process is maintained by Clearstream Default Management unit and regularly reviewed and approved by the respective Executive Board of Clearstream. In case of a crisis/client default, the default management process is governed by the respective Executive Board. The respective Executive Board may decide to handle the crisis in a flexible way, where necessary, therefore the actions taken in case of default are not automatic but decided on case-by-case basis taking into consideration among other factors the size of outstanding exposures and market risk.

5. Testing

The default management testing is an integral part of the Clearstream default management process. For the purpose of continuous improvement, the default management process is tested at least annually, involving all relevant stakeholders. The tests are also performed following any substantive changes to the default rules and procedures or upon request from the regulators. The results of any relevant test and any significant change to the default rules and procedures are reported to the respective Executive Board of Clearstream, the respective Supervisory Board Risk Committee and the competent authorities. A summary of the results and contemplated changes to the default rules and procedures are regularly published on this website and as such accessible to all Clearstream clients. Should a test highlight any weaknesses in the default rules and procedures or in their implementation, the Clearstream Default Management unit will inform the relevant stakeholders for the purpose of taking appropriate actions to remove such weaknesses.

Clearstream offers clients the opportunity to be involved in the Clearstream default management framework by going through Clearstream’s default rules and procedures as well as the testing activity with the Clearstream Default Management unit. The purpose is to enhance the general awareness of default management and get feedback from clients on the default rules and procedures in order to further improve the default management process. For further information, clients may contact their Relationship Officer.