German Stock Exchange and central counterparty (CCP) transactions

Non-cleared German Stock Exchange transactions

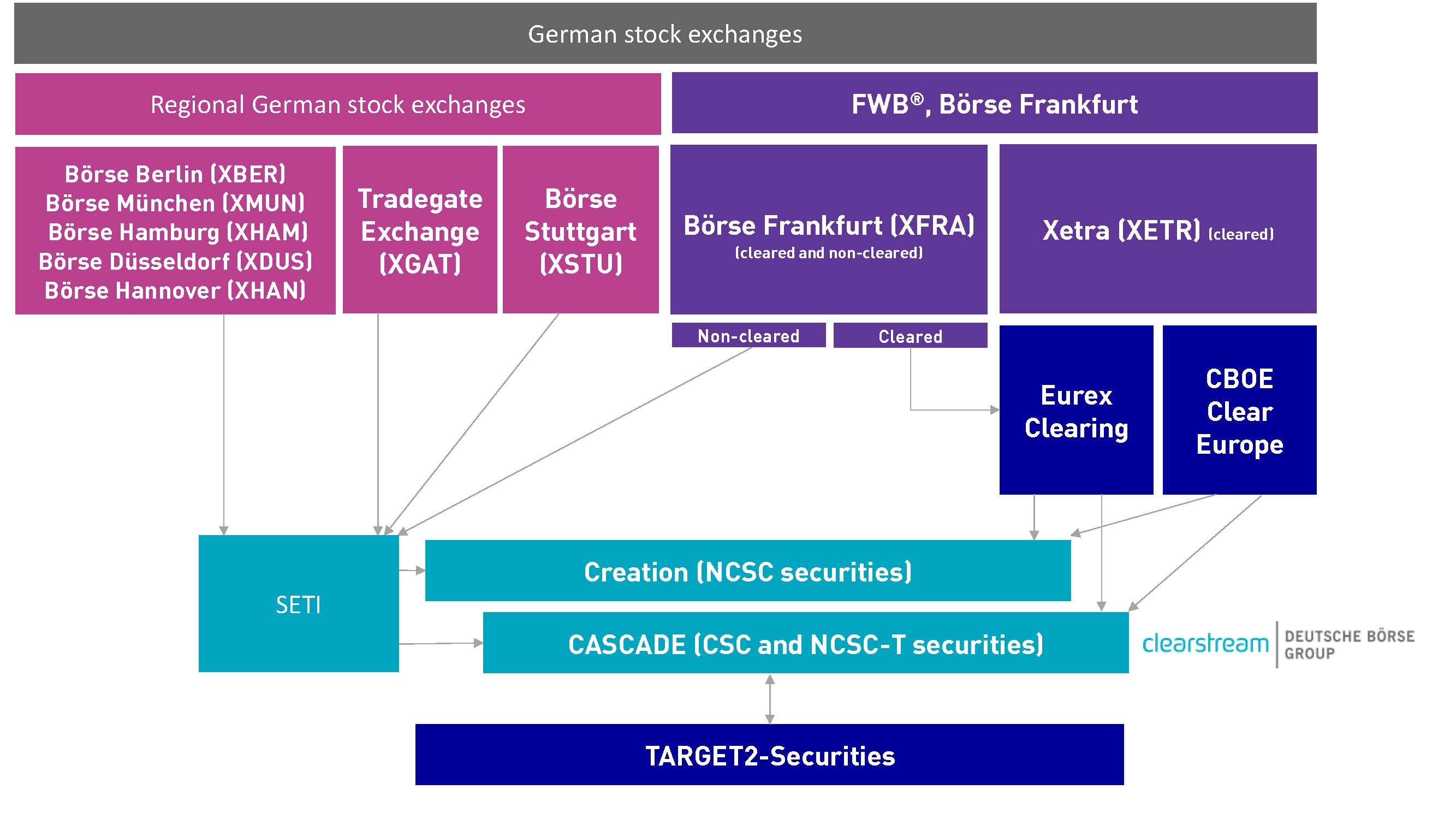

Non-cleared stock exchange trade confirmations from German Stock Exchanges are routed to CBF’s Stock Exchange Transaction Interface (SETI). After the transformation into OTC-like instructions, they are transmitted to the settlement platform based on the securities custody type:

- Instructions in collective safe custody (CSC) or T2S eligible non-collective safe custody (NCSC-T) securities are forwarded to T2S for settlement.

- Instructions in non-collective safe custody (NCSC) securities are forwarded to Creation for settlement.

Cleared transactions at Frankfurter Wertpapierbörse (FWB®, the Frankfurt Stock Exchange)

- There are two CCPs: Eurex Clearing AG (Primary CCP) and CBOE Clear Europe (Preferred CCP).

- Eurex Clearing AG clears transactions in all CCP-eligible instruments on trading venues Xetra® (XETR) and Börse Frankfurt (XFRA), while CBOE Clear Europe clears transactions in selected instruments (“multi-CCP-eligible”) on XETR only.

- Eurex Clearing AG sends CCP instructions (netted or gross transactions) in CSC or NCSC-T securities to CASCADE. These instructions are forwarded to T2S for settlement of securities and cash in EUR1. CBOE Clear Europe sends CCP instructions (netted or gross transactions) in CSC or NCSC-T securities to T2S for settlement of securities and cash in EUR.

- Instructions in NCSC securities are forwarded to Creation for settlement.

The settlement instructions are taken up for real-time processing applying the standard OTC functionality. Whereas the settlement of stock exchange instructions in CSC and NCSC-T securities with CBF follows the T2S rules, the settlement of stock exchange instructions in NCSC securities on the Creation platform is subject to CBL procedures:

Stock exchange transactions services | CBF clients | CBF-i clients |

Transaction linking | T2S rulesa | CBL rulesb |

Already-matched instructions | Yes | No |

Allegements | Yes | No |

Partial settlement | Yes | Yes |

Settlement priority | Yes | Yes |

Hold and release | Yes | Yes |

OTC Recycling Service | Yes | Yes |

Market and reverse claims

| Please refer to the Clearstream Transactions Management rules per market | Please refer to the Clearstream Transactions Management rules per market |

Transformations | Please refer to the Clearstream Transactions Management rules per market | Please refer to the Clearstream Transactions Management rules per market |

Bilateral cancellation | Yes | Yes |

Recycling period | T2S rulesc | CBL rulesb |

Reporting times | T2S scheduled | CBL scheduleb |

a. See Insights on T2S linking under T2S documents & links / Knowledge-based repository / Settlement / Linking instructions in T2S.

b. See CBL Client Handbook.

c. See T2S Scope Defining Documents, current T2S User Detailed Functional Specifications.

d. See Settlement process in T2S.

The figure below illustrates the settlement process for German Stock Exchange transactions :

To enlarge click on the image

----------------------------------

1. Transactions done in other currencies than EUR are processed through Creation by conditional settlement.