Broaden your opportunities with international products

Eurobonds have become an essential part of the issuer’s financing toolkit, both for global, established corporates and for emerging market participants seeking efficient access to liquidity.

Most recently, and with the variable interest rate environment affecting the G3 currencies, structured products have become increasingly attractive to both issuers and investors looking to expand their reach and portfolios.

Innovative issuance structures

Here are some highlights of the innovative issuance structures currently available through Clearstream:

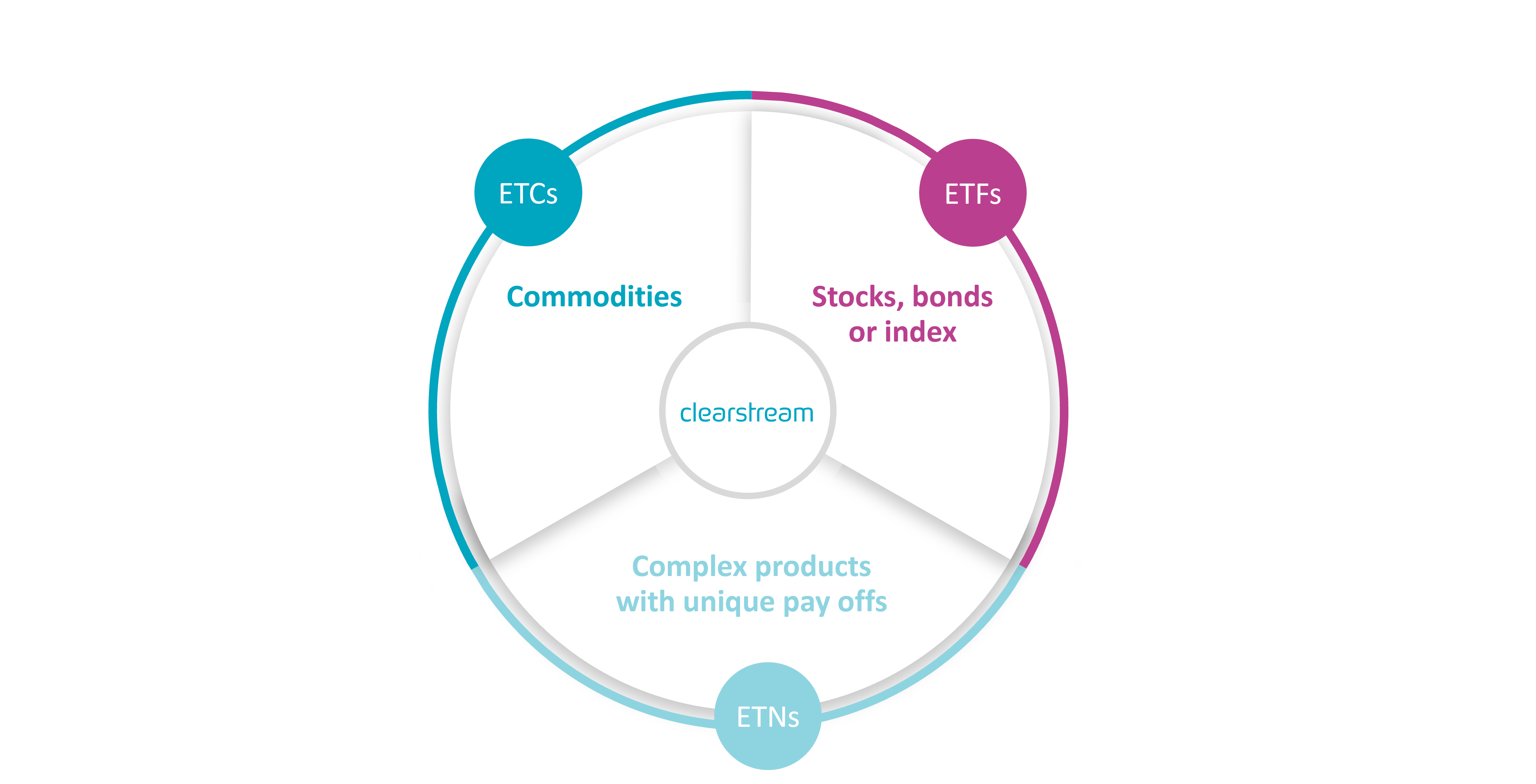

Exchange Traded Notes and Commodities (ETNs / ETCs)

These securities are typically zero-coupon notes or certificates that give investors exposure to the underlying assets. Issuers are SPVs and investors may receive cash or physical delivery of the underlying commodities, subject to eligibility requirements.

Exchange Traded Commodities (ETCs): An ETC is a type of security that allows traders and investors to gain exposure to commodities such as metals, energy, and crypto. They are structured as a debt/swap wrapper (like ETNs).

Exchange Traded Funds (ETFs): Similar to a mutual fund, ETFs contain a basket of investments such as stocks and bonds. An ETF tracks an underlying index, such as the S&P 500 but can also track an industry, sector or trend. They are structured as a fund wrapper.

Exchange Traded Notes (ETNs): ETNs track an underlying index of securities and are traded on major exchanges. However, ETNs are baskets of unsecured debt securities. Investors who buy ETNs do not own any of the securities in the index they track. They are swap-based.

Fund Linked Notes (FLNs)

Clearstream has launched a unique redemption option for Fund Linked Notes (FLNs) issuers. Upon redemption, issuers now have the option to redeem notes in cash or physical units in the underlying mutual fund, as opposed to the previous cash-only option.

Bond Linked Notes (BLNs)

Fractional bond linked notes have become increasingly popular with retail and private banking clients. These notes, typically issued by banks, give investors access to bonds that would usually be purchased by institutional buy-side clients. Recent structures have included US Treasuries, HK Govies and UK Gilt linked securities. Clearstream manages the full physical redemption of the notes and related underlying securities through our dedicated Asset Services team.

BLN Q&As

- Which securities can be structured in BLN transactions?

Any bond that is eligible for acceptance in Clearstream can be used as an underlying in a BLN.

- What is the eligibility process for BLNs in Clearstream?

A BLN must go through the same eligibility process as all structured products and have the relevant supporting documentation outlining the transaction.

- Can the issuer deliver the underlying bond to Clearstream to further credit to the noteholder?

Yes, this is the standard payment method.

- What is the process for redeeming the BLNs upon physical delivery of the underlying bonds?

Once the result is known, it will be communicated to Clearstream via MT564 from the Common Depository. Upon receipt, Clearstream aims to deliver this information to bondholers within 1 business day. Similarly, the 1 business day turnaround applies to payment of bond proceeds upon redemption settlement.

- How many days in advance of the settlement date for physical delivery should the issuer notify Clearstream of the exercise notice to holders?

For International / Eurobonds, the expectation is Fixing Date + 1 Business Day, subject to the Issuer’s processes.

Global Depository Notes and Receipts (GDNs / GDRs)

Clearstream is working with key partners to support the new GDR and GDN structures, a long-standing and popular asset class that provides investors with access to otherwise hard-to-reach jurisdictions. These securities target investors seeking exposure to developing markets such as those in Asia and Latin America, and often require more robust asset servicing and beneficial holder identification. Clearstream’s innovative approach to these requirements means that we connect issuers and investors through our international product environment.

For more information, please contact primarymarketrelations@clearstream.com.